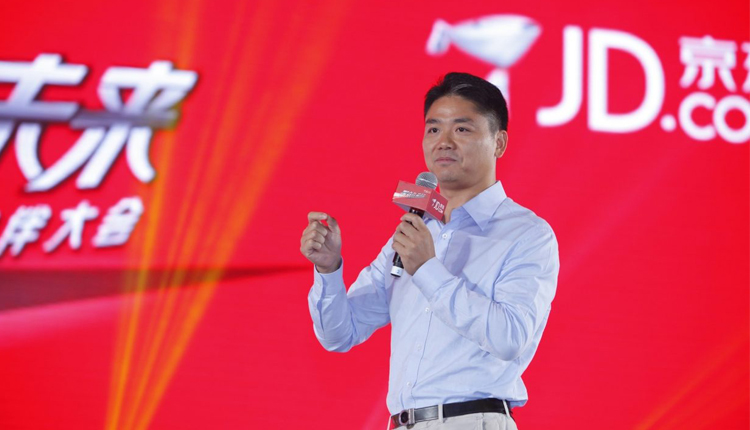

China JD.com CEO warns trade war would hurt ‘a lot of American brands’

A lengthy trade war between China and the United States would be “horrible” and it would end up hurting a lot of American brands, said the founder of China’s second-largest e-commerce company.

That is because more Chinese consumers now have a preference for buying imported goods, Richard Liu, founder and CEO of JD.com, told CNBC’s Eunice Yoon.

“For the next five years, or 10 years, I’m sure in the larger cities, almost half the shopping will come from imported goods,” Liu said.

That means American companies would have an opportunity to sell to a large Chinese consumer base that is eager to buy foreign products.

“But if it’s a long-term (trade) war, it will be horrible,” Liu said, telling CNBC it would “hurt a lot of American brands.”

Planning for the future

JD.com competes with Jack Ma’s Alibaba in China’s massive e-commerce market. Both companies have invested significantly in technology, retail and logistics to win over consumers. Those include opening high-tech supermarkets and testing drone delivery to reach China’s rural consumers.

Gil Luria, director of research at D.A. Davidson & Co told CNBC’s “The Rundown” on Monday that both companies are important to watch. While Alibaba added a media business and a successful cloud business to augment its growth, Luria said JD.com was more of a “pure retailer.”

“They’re singularly focused on being a fantastic retailer,” he said. “They have the advantage on logistics, they have the advantage on quality and they have the alignment with Tencent, which is incredibly important because of the relationship with WeChat.”

Tencent is one of China’s major technology giants and its businesses include messaging platform WeChat, which is used extensively internationally and in China, where it is known as Weixin. In March, the company revealed that WeChat hit one billion monthly users for the first time.

As a result of the partnership, JD.com is able to sell directly to consumers through Tencent’s WeChat app.

Moreover, Tencent and JD.com have also teamed up to challenge Alibaba’s stronghold in the e-commerce space. Last year, the two firms reportedly said they would pay $863 million for a 12.5 percent stake in Vipshop Holdings, which sells discounted fashion and accessories from global brands.

Luria explained that it made sense for JD.com to invest in its business since there’s still a very large opportunity in China. In fact, he added, if JD.com did not invest in new technologies and important tools, they would not be able to catch up or compete with Alibaba.

“You have to prepare for your future growth at least three, or even five, years earlier,” Liu told CNBC. “For JD, most important to us is, you know, our supply chain service based on our logistics system. And second is technology.”

He added that JD.com planned to reduce the comparatively high logistics costs in China. But across the Pacific, both Alibaba and JD.com’s attempts to make in-roads into the U.S. have been slow.

Trade tensions

The tense climate between Washington and Beijing will affect JD.com’s confidence and expansion plans into the U.S., Liu said. He explained that his company previously wanted to invest in a lot of projects and firms stateside. The current situation, however, gave the e-commerce giant pause, according to the founder.

“Last year we planned to go to the U.S. market from this year, but now we have to wait,” Liu said.

Trade tensions between the two countries escalated on Friday, after the United States Trade Representative announced that the U.S. would initially impose an additional 25 percent tariff on 818 Chinese imports worth about $34 billion on July 6.

Duties on an additional $16 billion worth of goods from China would need to undergo public review. If approved, that would bring the total to $50 billion worth of Chinese goods.

For its part, Beijing swiftly retaliated and said it would levy a 25 percent tariff on $34 billion of U.S. goods, taking effect on July 6. The list of goods included soybeans, electric vehicles and a variety of seafood and pork, according to the Ministry of Commerce.

Still, many analysts said Beijing and Washington were likely to come to an agreement that could avoid the levying of tariffs on imported goods.

“The hope is that this is just brinkmanship and an arrangement will be arrived at by the governments to avoid such tariffs,” Luria said.

He added that many companies and consumers would suffer a negative impact if both governments followed through on their recent announcements.

Source: CNBC