Egypt’s foreign reserves increase reflects sound, balanced monetary policy – expert

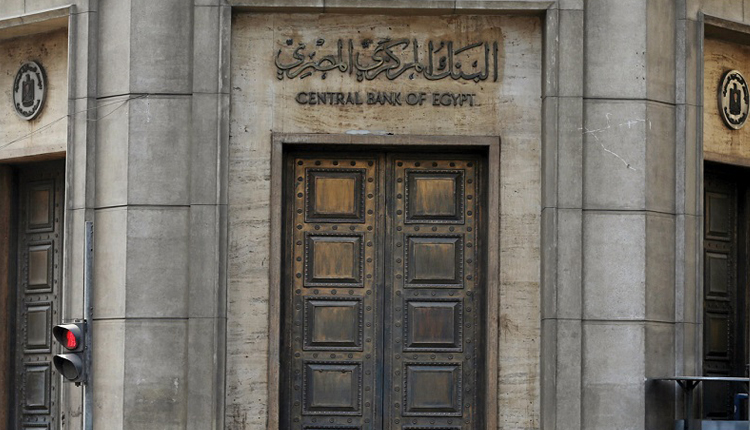

Former secretary general of the Egyptian Banks Federation and banking expert Abdel-Rahman Baraka said increasing Central Bank of Egypt (CBE) foreign reserves is a sign that Egypt has adopted a sound, successful and balanced monetary policy.

Speaking to Ahram Online, Baraka asserted that the situation sends a positive message to investors that Egypt’s economic environment is sound for further investment and establishing new projects.

In addition, Baraka said, it means that Egypt has the ability to repay its debts in hard currencies in due time, expecting that reserves will continue to rise in 2020.

Foreign exchange reserves in Egypt increased to $45.354 billion in November from $45,247 billion in October 2019, an increase of $107 million, which is the highest it has ever reached to date.

Meanwhile, the CBE’s gold reserves value was estimated at $3.148 billion in November, down from $3.267 billion in October, a decrease of $119 million, according to CBE data.

Hard currencies registered $41.930 billion in November up from $41.611 billion in October, rising by $319 million.

Foreign exchange reserves in Egypt averaged $22.026 billion from 1992 until 2019, reaching an all time high of $45.354 billion in November 2019, with a record low of $100.88 million in June 1992, according to CBE data.

Foreign exchange reserves are foreign assets controlled by the CBE, comprised of gold or a specific currency.

They can be used to gain special drawing rights from international financial institutions, and as marketable securities denominated in foreign currencies, like treasury bills, government bonds, corporate bonds and equities and foreign currency loans.

Source: Ahram Online