During Wednesday midday session, the Egyptian Exchange (EGX) has posted remarkable gains of EGP 7.7 billion as the capital market has amounted to EGP 395.259 million, according to data compiled by Amwal Al Ghad at 12:57 p.m. Cairo time (10:57 GMT).

EGX indices hit green.

The main index, EGX30 soared by 2.60% to hit 5711.57 p. EGX20 jumped by 3.37% to reach 6683.78 p.

Meanwhile, the mid- and small-cap index, the EGX70 climbed by 2.85% to hit 531.99 pts. Price index EGX100 rose by 2.43% to reach 883.64 p.

Traded volume reached 121.871 million securities worth EGP 299.028 million, exchanged through 16.660 thousand transactions.

This was after trading in 157 listed securities; 7 declined 138 advanced while 12 keeping their previous levels.

EGX’s midday gains were backed by Arabs and non-Arab Foreigners’ buying deals.

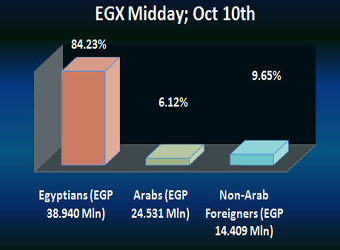

Arabs and non-Arab Foreigners were net buyers seizing 6.12% and 9.65% respectively, of the total markets, with a net equity of EGP 24.531 million and EGP 14.409 million excluding the deals.

On the other hand, Egyptians were net sellers seizing 84.23% of the total markets, with a net equity of EGP 38.940 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during midday trading.

Orascom Construction Industries:

Trading has been suspended for Orascom Construction Industries – OCI (OCIC.CA)

The EGX Chairman Mohamed Omran said the bourse has suspended trading in Orascom Construction Industries (OCI) – (OCIC.CA)’s stocks awaiting the firm’s comments on the news published by Amwal Al Ghad regarding its EGP 14 billion tax fraud.

Egyptian Tax Authority sources told Amwal Al Ghad that the authority had called the Egyptian tycoon Onsi Sawiris alongside his son Nassif Sawiris to start interrogations regarding Orascom Construction Industries (OCI) – (OCIC.CA)’s evading to pay EGP 14 billion tax dues to the state.

The Egyptian Tax Authority has decided to call the Egyptian tycoon Onsi Sawiris and his son Nassif Sawiris to start interrogations regarding Orascom Construction Industries (OCI) – (OCIC.CA)’s evading to pay EGP 14 billion tax dues to the state.

President Morsi stated Saturday that Egypt is owed about EGP 100 billion by five companies adding that the state is in talks with these entities to have its dues. The President clarified that some of these dues arose from financial irregularities or tax evasions.

The sources further told Amwal Al Ghad that the selling deal of OCI’s Orascom Building Materials Holding to French Lafarge in 2008 has been reviewed referring that the deal has violated the law leading to tax fraud.

It is worth mentioning that OCI sold in 2007 its entire stake in Orascom Building Materials Holding (OBMH) to French Lafarge at $ 12.9 billion.

The tax sources added that OCI had founded Orascom Building and had listed it in the EGX for a short while, transferring to it the Lafarge deal valued at EGP 71 billion.

On the other hand, OCI noted on Monday that the capital gains from selling its entire stakes in the EGX-listed Orascom Building Materials Holding to Lafarge are tax exempt.

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock jumped by 5.15% to reach EGP 4.08.

Citadel Capital Chairman and Founder Ahmed Heikal said the firm has already invested $4 billion in Egypt since January 2011, when an uprising erupted that toppled President Hosni Mubarak. Citadel has an eye on infrastructure and energy-related projects, he added during Euromoney conference on Tuesday.

“I met a number of government officials and we think we are ready to invest a significant amount of money, probably higher than the $4 billion over the next three years,”

“We identified a number of opportunities in the energy efficiency, infrastructure sphere,” he said.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) soared by 4.02% to hit EGP 11.90.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) rose by 3.77% to hit EGP 0.55.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) hiked by 2.31% to reach EGP 3.55.