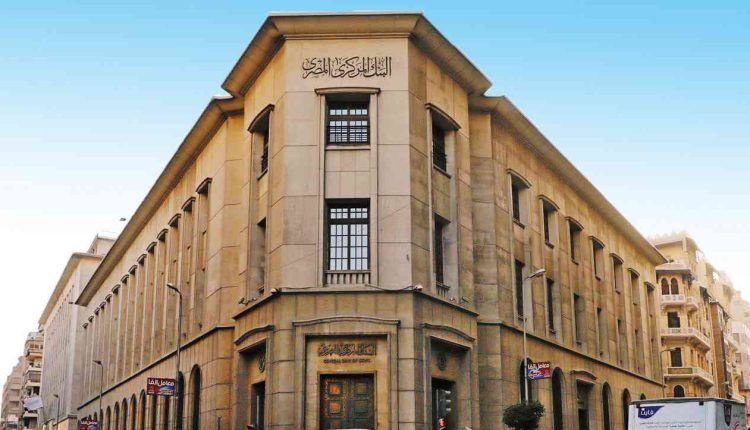

Egypt’s central bank has on Thursday decided to hike interest rates by 2 percent to step efforts to contain inflationary pressures which is consistent with achieving price stability over the medium term.

The central bank’s Monetary Policy Committee (MPC) has raised the overnight deposit rate, overnight lending rate, and the rate of the main operation by 200 basis points to 11.25 percent, 12.25 percent, and 11.75 percent, respectively, the bank said in a statement.

The discount rate was also raised by 200 basis points to 11.75 percent.

“The MPC decided that raising policy rates is necessary to contain inflationary pressures which is consistent with achieving price stability over the medium term.

Monetary policy tools are utilised to anchor inflation expectations, contain demand–side pressures and second–round effects emanating from supply shocks that may lead to deviations from inflation targets.”MPC statement read.

“Therefore, in accommodation of the first–round effects of supply shocks, the elevated annual headline inflation rate will be temporarily tolerated relative to the CBE’s pre–announced target of 7 percent (±2 percentage points) on average in 2022 Q4, before declining thereafter. Achieving low and stable inflation over the medium term is a prerequisite condition to achieve high and sustainable growth rates, as well as supporting real incomes.

“The MPC reiterates that the path of future policy rates remains a function of inflation expectations, rather than of prevailing inflation rates. The MPC will continue to closely monitor all economic developments and will not hesitate to utilise all available tools to achieve its price stability mandate over the medium term.”