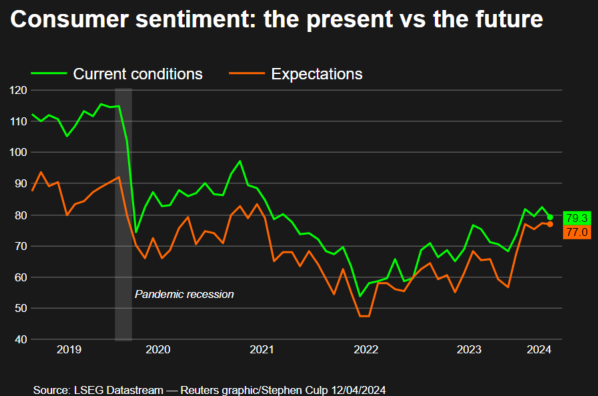

A University of Michigan survey revealed a decline in US consumer sentiment in April. This coincides with rising household expectations for inflation in the coming year, potentially influencing the Federal Reserve to postpone interest rate cuts until September.

The survey follows data released earlier this week showing higher-than-expected consumer price increases for a third consecutive month. This, coupled with a robust labor market, has led financial markets and most economists to revise their forecasts. They now anticipate the first Fed rate cut in September, rather than June, and a total of two cuts instead of three.

However, signs suggest inflation may not be escalating out of control. Producer prices saw moderate growth last month, further supported by data showing a near standstill in import prices (excluding fuel) in March after a surge earlier this year.

“While the rise in inflation expectations isn’t ideal for the Fed, it remains consistent with recent trends and doesn’t suggest a major break from expectations,” commented Eugenio Aleman, chief economist at Raymond James.