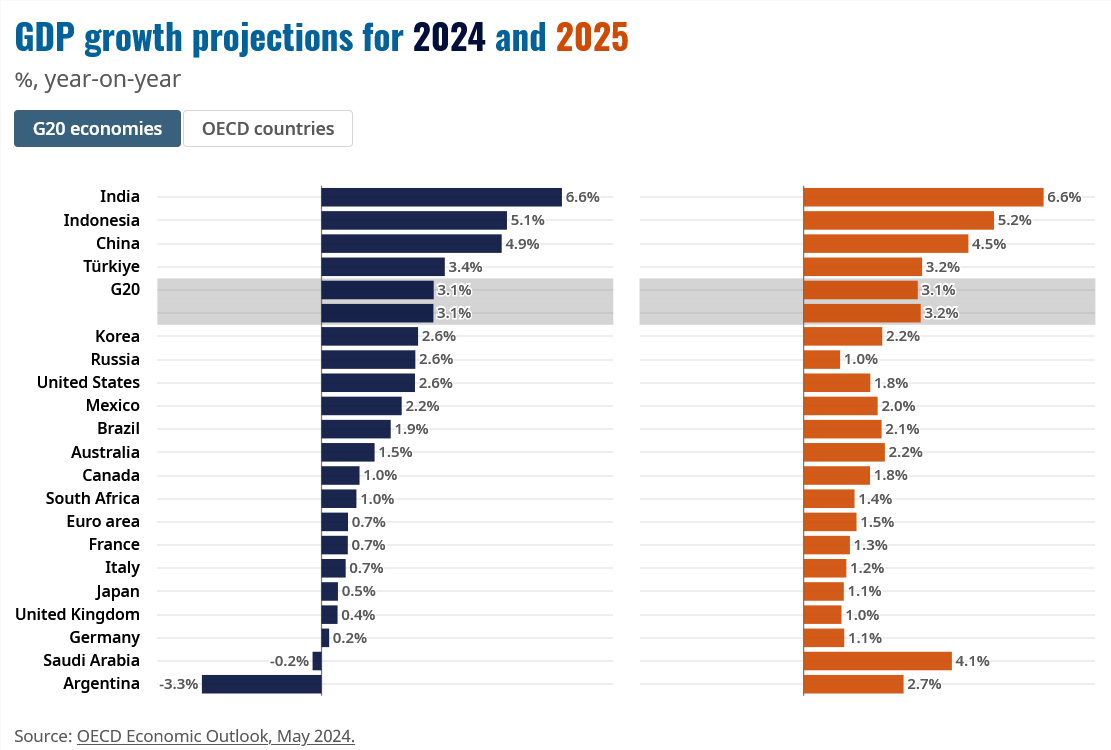

The eurozone is likely to see GDP growth of 0.7 per cent in 2024, and 1.5 per cent in 2025, according to the Organisation for Economic Cooperation and Development’s (OECD) latest Economic Outlook released on Thursday.

The recovery is anticipated due to an increase in domestic demand, despite the geopolitical uncertainties that have kept the economy stable with no change in GDP in the last quarter of 2023.

This marks an upward revision from OECD’s Interim Economic Outlook issued in February, in which the Paris-based organisation predicted the euro area economy to grow by 0.6 per cent in 2024 and by 1.3 per cent in 2025.

Inflation has seen a decrease from 2.6 per cent in February to 2.4 per cent in March, with core inflation dropping from 3.1 per cent in February to 2.9 per cent in March.

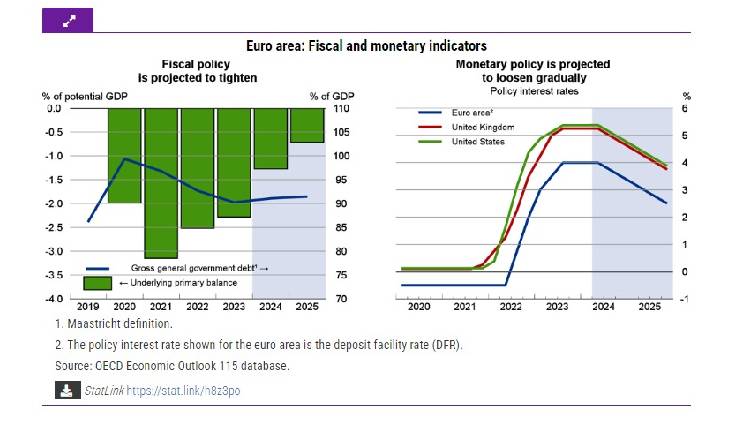

The fiscal stance of the Euro area is projected to remain restrictive in 2024 and 2025, with a cumulative tightening of 1.5 per cent of GDP.

The European Central Bank (ECB) maintains a restrictive monetary policy with a deposit facility rate of 4 per cent, expected to stay until Q3 2024, then gradually decline to 2.5 per cent by the end of 2025.

Public investment is estimated to rise by 2.5 per cent of GDP by 2026 due to the Next Generation EU (NGEU) programme, potentially leading to a 5 per cent increase in private investment over time. Growth is expected to rebound gradually, supported by easing financial conditions, benign energy and commodity prices, and reduced uncertainty.

However, the risks to these projections are mainly to the downside. Increased geopolitical tensions and higher transport costs due to Red Sea shipping disruptions could add to inflationary pressures and weigh on external demand.

Financial stability risks in the euro area remain high due to increasing bankruptcies and potential losses from non-performing loans and real estate exposures due to high interest rates.