Asian stocks edged lower on Tuesday as investors awaited the release of the Federal Reserve’s latest policy meeting minutes, Reuters reported. The minutes are expected to shed light on the central bank’s stance on potential interest rate cuts this year.

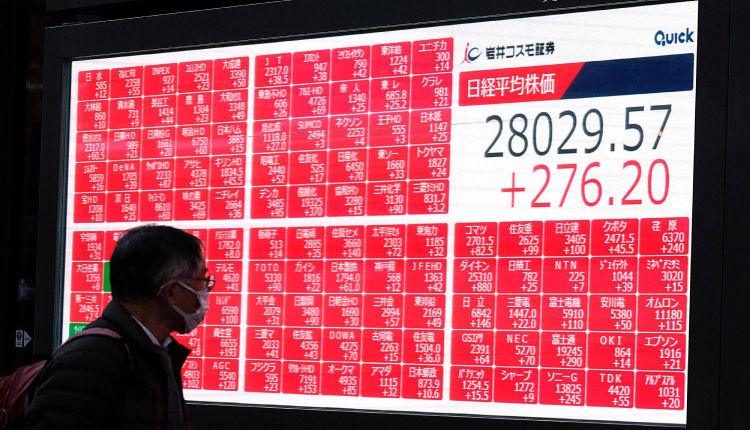

Japan’s Nikkei index, however, defied the trend, rising slightly on the back of strong performance by chipmakers. This followed a record high close for the Nasdaq overnight, fuelled by positive sentiment ahead of Nvidia’s earnings report.

Market expectations currently point towards a total of 41 basis points in Fed rate reductions by year-end, with a quarter-point cut priced in for November.

This cautious optimism stems from data indicating a slight easing of consumer price pressures in April.

However, Federal Reserve officials remain wary of declaring victory over inflation. Both Vice Chairs, Philip Jefferson and Michael Barr, emphasised the need for continued vigilance and a wait-and-see approach before loosening monetary policy.

Other Markets

The broader MSCI Asia-Pacific index outside Japan fell 0.6 per cent, dragged down by losses in Hong Kong’s Hang Seng index.

US stock futures were mixed, with Nasdaq futures slightly lower 0.1 per cent after the tech-heavy index closed at an all-time high on Monday.

The dollar index edged higher 0.1 per cent, while the 10-year Treasury yield remained relatively unchanged at 4.4453 per cent.

Oil prices fell 0.1 per cent to $83.34 a barrel due to concerns over high US interest rates impacting economic activity.

Gold eased 0.2 per cent to about $2,420 per ounce, after pushing to the cusp of $2,450 for the first time overnight.