Turkey’s central bank is expected to overlook a surge in inflation to around 75 per cent this month, likely maintaining an interest rate pause based on more optimistic projections, Bloomberg reported on Wednesday.

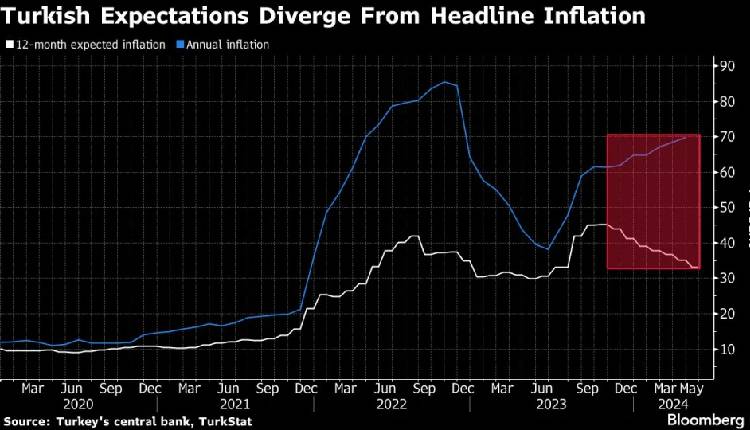

Despite having the highest nominal rates among the G20 nations and contending with one of the world’s fastest inflation rates, Turkey has seen a rare decline in inflation expectations.

As inflation is predicted to start slowing next month, economists unanimously agree for the first time since February that policymakers will maintain their benchmark at 50 per cent on Thursday.

Major global banks, including UBS Group AG and Citigroup Inc., forecast a rate cut before the end of the year.

Despite a second consecutive hold, policymakers are not expected to become less hawkish, especially after Governor Fatih Karahan pledged to do “whatever it takes” to control prices and subsequently raised the central bank’s year-end inflation target to 38 per cent.

Rate hikes are still a possibility, according to lenders such as Morgan Stanley and HSBC Holdings Plc. If inflation momentum does not improve by June, further tightening may be discussed, said HSBC economist Melis Metiner.

Metiner emphasised that the upcoming Consumer Price Index (CPI) releases will be crucial in determining policy decisions.