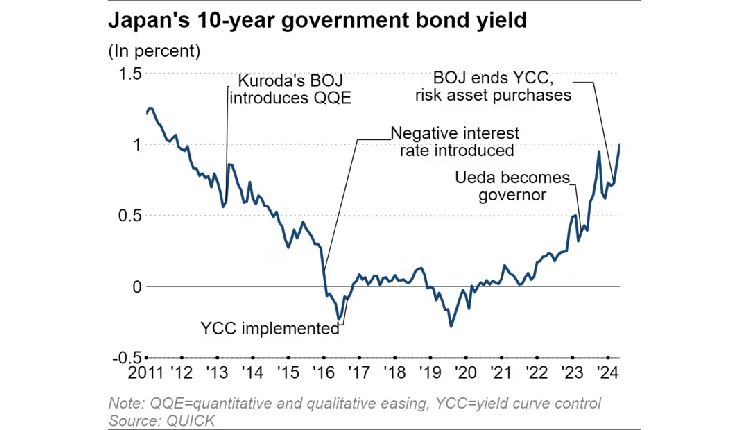

Japanese government bond yields hit an eleven-year high on Wednesday, driven by investor expectations of a potential interest rate hike or reduction in bond purchases by the Bank of Japan, the Nikkei Asia reported.

The 10-year JGB yield rose to one per cent, the highest since May 2013, with a 0.38 percentage point increase this year as the BOJ shifts from its ultra-loose monetary policy.

The BOJ started moving towards policy normalisation in March by ending negative interest rates and its yield-curve control programme.

The wide gap between US and Japanese interest rates is weakening the yen, prompting investors to anticipate potential interest rate hikes or reduced bond purchases by the BOJ to stabilise the yen.

This week’s auction of 40-year ultra-long-term government bonds revealed low investor demand, suggesting an anticipation of future yield increases and falling bond prices. Bond prices move inversely to yields.

The rise in bond yields reflects a global trend of investors shifting away from safe-haven assets like bonds and towards riskier assets like stocks and commodities. This risk-on appetite puts downward pressure on bond prices.

The 10-year JGB yield plays a crucial role in determining fixed mortgage rates and long-term borrowing costs for companies. Rising yields also lead to higher government spending on debt servicing.