UK business activity growth accelerates in August – PMI

The UK service sector continued its post-election recovery in August, with business activity and new orders expanding at a solid pace, according to the latest PMI survey released on Monday. This was in addition to the easing inflationary pressures across the service economy.

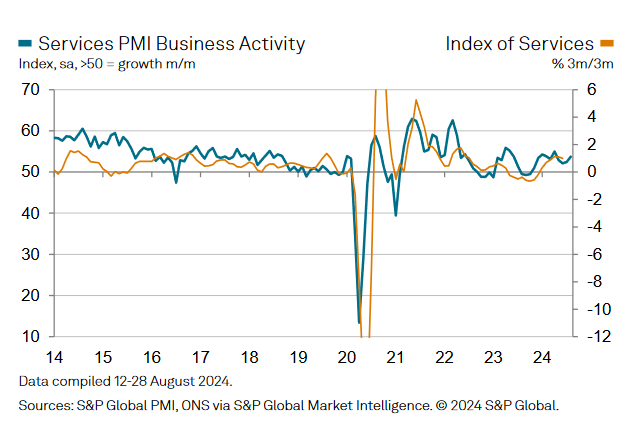

The S&P Global UK Services PMI rose to 53.7, indicating a strong upturn. This was accompanied by easing inflationary pressures across the service economy.

The UK business activity growth has now rebounded to its highest since April. However, indicative of a solid upturn in service sector output, the latest reading was still slightly below the long-run survey average (54.4).

Total new business growth was only fractionally lower than the 14-month high experienced in July, thereby reflecting a strong recovery in demand conditions after the soft patch in the run up to the general election.

Moreover, export sales were relatively subdued in August.

Latest data showed only a marginal rise in new work from abroad and the rate of expansion slowest to its weakest since October 2023. “Brexit-related trade difficulties were again cited as holding back sales to EU clients. Those reporting export order book growth often commented on demand from North America and emerging markets.” the survey read.

Service sector firms experienced another marked reduction in backlogs of work during August, reflecting ongoing efforts to boost business capacity and process unfinished orders. “The latest decline in backlogs was the sharpest for 12 months.”

Private sector output growth gains momentum at 53.8 in August, from 52.8 in July, the seasonally adjusted S&P Global UK PMI Composite Output Index reflects a solid expansion of private sector business activity.

The latest reading pointed to the fastest pace of growth since April. “Higher levels of output were seen in both the manufacturing and service sectors.”

August data also showed a sustained upturn in private sector employment, buoyed by additional hiring in both manufacturing and services. Inflationary pressures eased in August, with private sector firms indicating the weakest rise in input costs since November 2020.

“August data highlighted a recovery in UK service sector performance as improving economic conditions and domestic political stability helped to bolster customer demand. New business again increased at a robust pace after a lull in decision-making earlier this summer.” Tim Moore, Economics Director at S&P Global Market Intelligence, said. “This fuelled the fastest upturn in service sector activity since April and extended the current period of growth to ten months.”

“The modest post-election bounce in business activity expectations faded, however, in August. Hopes of interest rate cuts and steady improvements in broader economic conditions helped to support confidence, but some firms cited concerns about policy uncertainty in the run up to the Autumn Budget.” Moore concluded.

Attribution: S&P Global UK Services PMI®