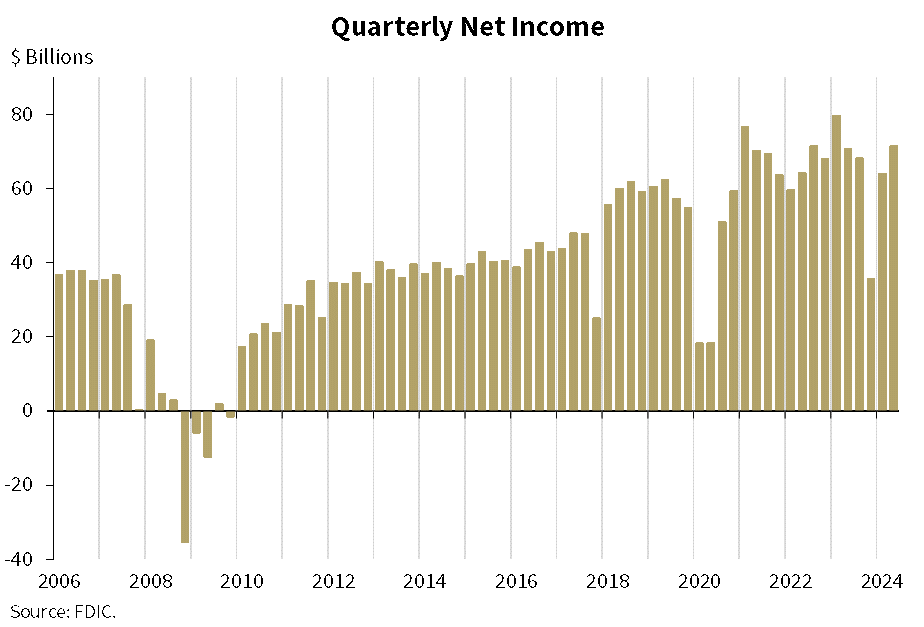

The US banking industry reported a significant increase in profits during the second quarter of 2024, driven by reduced expenses and increased non-interest income. However, the Federal Deposit Insurance Corporation (FDIC) also highlighted growing concerns about commercial real estate and credit card loan portfolios.

Reports from 4,539 commercial banks and savings institutions insured by the FDIC reported aggregate net income of $71.5 billion in second quarter 2024, an increase of $7.3 billion, up 11.4 per cent from the previous quarter.

The non-current rate for non-owner-occupied commercial real estate loans rose to its highest level since 2013, indicating potential financial difficulties for borrowers in this sector. Additionally, the net charge-off rate for credit cards reached its highest point since 2011, suggesting increased credit card delinquencies.

Despite these concerns, bank profits were boosted by a $4 billion reduction in expenses related to the special assessment imposed to cover the costs of bank failures in 2023. One-time gains from equity security transactions also contributed to the profit increase.

While non-interest expenses declined overall, provision expenses for potential loan losses rose, particularly for larger banks.

“The banking industry continued to show resilience in the second quarter. Net income increased and asset quality metrics remained generally favourable.” FDIC Chairman Martin J. Gruenberg said.

“However, the banking industry still faces significant downside risks from uncertainty in the economic outlook, market interest rates, and geopolitical events. In addition, weakness in certain loan portfolios, particularly office properties, credit cards, and multifamily loans, continues to warrant monitoring.”

Attribution: FDIC