The total profit of the UAE’s insurance sector surged to AED2.5 billion in 2023, compared to AED1.96 billion in 2022, according to a recent report by the Central Bank of the UAE (CBUAE). The increase was mainly driven by increase in net investment income of the insurance sector last year.

The CBUAE’s Annual Statistical Report also revealed a rise in the total number of written insurance policies (all types) to 14.6 million in 2023, compared to 8.4 million in 2022. The increase was buoyed by the higher number of property and liability insurance policies, especially in Involuntary Loss of Employment Insurances policies in 2023.

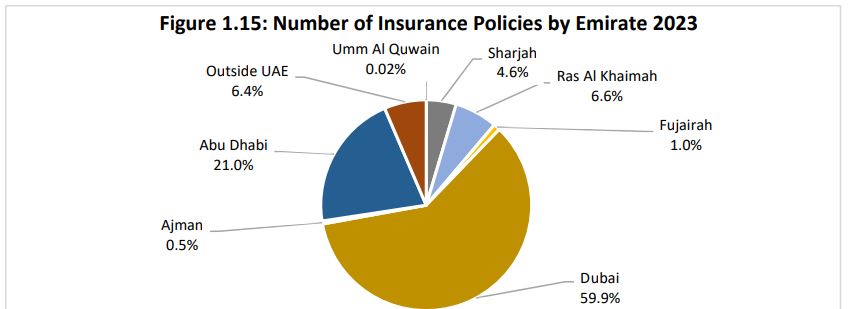

According to the report, Dubai dominated the market with a 59.9 per cent share, followed by Abu Dhabi at 21 per cent, Ras Al Khaimah at 6.6 per cent, Sharjah at 4.6 per cent, Fujairah at 1 per cent, and Ajman at 0.5 per cent. Approximately 6.4 per cent of policies were written outside the UAE.

Additionally, gross written premiums increased to AED50.4 billion in 2023 from AED44.1 billion in 2022, with Dubai accounting for 61 per cent and Abu Dhabi for about 27.7 per cent.

Moreover, gross paid claims also rose to AED30.3 billion, up from AED26.5 billion in 2022, with Dubai responsible for 60.7 per cent of claims and Abu Dhabi for 28.9 per cent.

Attribution: The CBUAE

Subediting: Y.Yasser