Asian equities dropped on Wednesday due to disappointing earnings from ASML, Europe’s largest tech firm, which affected chip stocks globally.

The market was also impacted by underwhelming results from LVMH, a French luxury company, indicating a decline in demand for luxury goods in China.

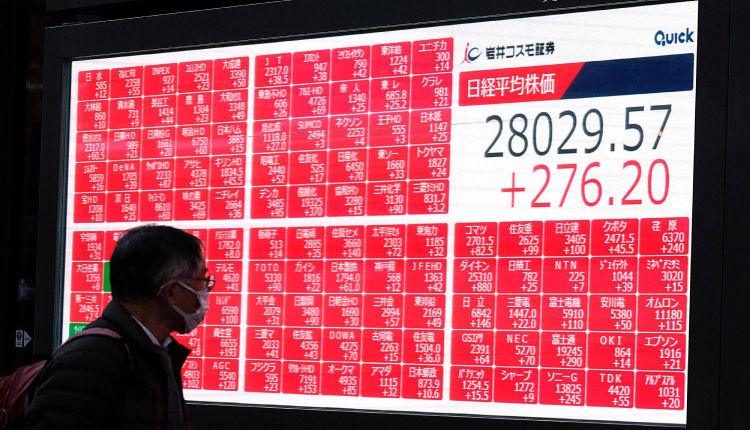

South Korea’s tech-heavy index fell 0.6 per cent, while chip stocks led Japan’s Nikkei 1.8 per cent lower. Taiwan stocks also slipped 1.2 per cent, contributing to a 0.32 per cent decline in the broader MSCI Asia-Pacific Index excluding Japan.

Investor sentiment remained cautious as the US election on November 5th approaches. Matt Simpson, a senior analyst at City Index, highlighted investors’ potential risk aversion and their desire to secure profits before the election.

The blue-chip CSI300 index dropped 0.6 per cent, while Hong Kong’s Hang Seng Index was down 0.7 per cent. All eyes are now on China’s press conference scheduled for Thursday, where they will discuss promoting “steady and healthy” development in the property sector.

The Japanese yen remained stable at 149.155 per dollar but has depreciated by 3.6 per cent in October due to the Bank of Japan’s (BOJ) dovish stance.

Oil prices held steady after significant declines in the previous session, as investors grapple with uncertainty surrounding tensions in the Middle East and their potential impact on global supply.

Brent crude oil futures edged up 0.4 per cent to $74.56 a barrel, while US West Texas Intermediate crude futures rose 0.5 per cent to $70.93 per barrel.

Attribution: Reuters

Subediting: M. S. Salama