European shares were in mixed notes on Tuesday amid a busy earnings season and a global bond selloff influenced by diminishing expectations of US Federal Reserve rate cuts.

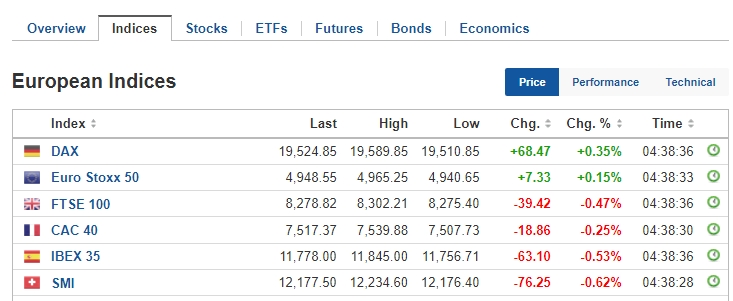

By 4:38 ET (8:38 GMT), the pan-European STOXX 600 index rose 0.15 per cent, with Germany’s DAX was 0.35 per cent higher. However, France’s CAC 40 fell 0.25 per cent, weighed down by losses in the energy sector, particularly for Engie and TotalEnergies SE.

Other major indices also declined, with Switzerland’s SMI going down by 0.62 per cent, the UK’s FTSE 100 dropping 0.47 per cent following a larger-than-expected UK deficit, and Spain’s IBEX 35 decreasing by 0.53 per cent.

Another key economic data involves the International Monetary Fund‘s (IMF) release of its updated global growth forecasts later the day.

IMF Managing Director Kristalina Georgieva recently indicated a lackluster outlook for the global economy, projecting slow medium-term growth and ongoing challenges in China and Europe.

Additionally, European Central Bank (ECB) policymaker Gediminas Simkus suggested the ECB may need to lower its key interest rate below the “natural” level of 2 per cent to 3 per cent if inflation continues to weaken.

Attribution: investing.com, Amwal Al Ghad English, Reuters, Bloomberg

Subediting: Y.Yasser