Asian stocks fell on Thursday, following weakness in the chip sector following overnight losses on Wall Street. Concerns over rising costs for artificial intelligence, highlighted by Meta Platforms’ warning, further dampened investor sentiment.

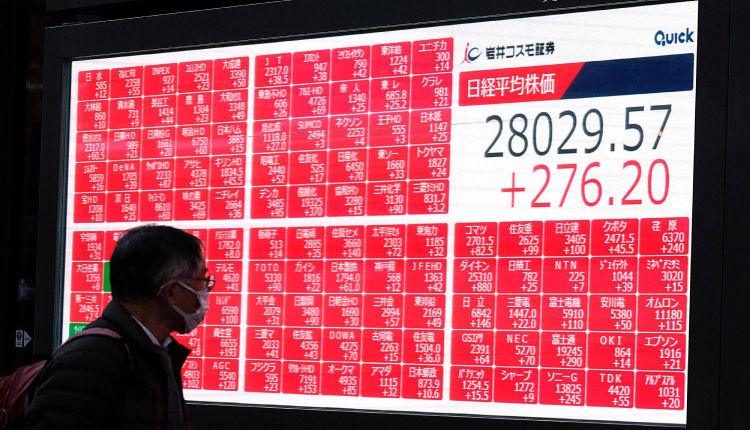

Japan’s Nikkei index fell 0.5 per cent, while South Korea’s Kospi dropped 1.3 per cent. Hong Kong’s Hang Seng index gained 0.2 per cent, but mainland Chinese blue chips slipped 0.7 per cent. Taiwanese markets were closed due to a typhoon.

The yen weakened against the dollar, hovering near a three-month low. Political instability in Japan, stemming from recent election results, could delay the normalisation of monetary policy. The Bank of Japan maintained its current monetary policy stance, citing uncertainties in the economic outlook.

Investors are also cautious ahead of key economic events, including the US non-farm payrolls report, the presidential election, and the Federal Reserve’s policy decision.

The US dollar index was steady, while the dollar strengthened against the yen. Gold prices reached a new all-time high, and oil prices extended their rally on optimism about US fuel demand.

Attribution: Reuters

Subediting: Y.Yasser