Asian stocks dipped as the dollar remained strong on Tuesday. The focus was on Bitcoin, which reached a record high due to investor optimism following Donald Trump’s election win.

Investors expect Trump’s second term to bring tax cuts and relaxed regulations, boosting assets like bitcoin, which hit an all-time high of $89,637.

MSCI’s Asia-Pacific index, excluding Japan, fell by one per cent, followed by Taiwan and South Korea, with declines of two per cent and one per cent respectively.

Chip stocks in the region have been under pressure following reports that the US has instructed Taiwan Semiconductor Manufacturing Co to stop shipments of advanced chips to Chinese customers for AI applications.

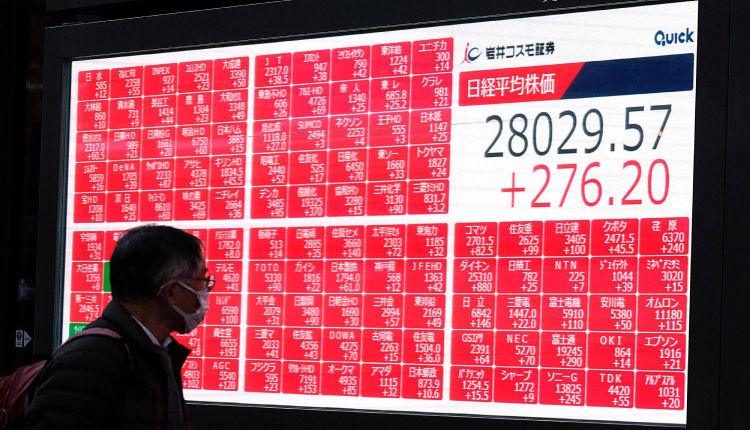

In contrast, Japan’s Nikkei was up 0.5 per cent due to a weak yen trading near three-month lows at 153.93 per dollar.

The euro faces pressure due to potential tariffs from the new White House administration, leading to near seven-month lows of $1.0687.

On the other hand, the dollar is expected to benefit from policies that may keep US interest rates higher for longer. The dollar index, measuring the greenback against six peers, was at 105.57, close to a 4-month high.

Vasu Menon, managing director of investment strategy at OCBC, noted that Trump’s decisive win removes uncertainty from the US election outcome.

“The medium-term outlook could become cloudier if Trump pursues aggressive tariff hikes … This could fuel inflation eventually and stop the Fed from cutting rates. Tariffs also carry the risk of retaliation from the major trading partners.”

Wall Street closed at record highs, with Tesla gaining nine per cent and reaching a $1 trillion market value, driven by optimism over CEO Elon Musk’s support of Trump.

However, Chinese shares rose slightly, but Hong Kong stocks fell by one per cent. Investor sentiment was dampened as Beijing’s recent stimulus package did not include the expected direct consumer spending.

This week, investors will focus on US consumer price inflation data and speeches from Federal Reserve officials, including Fed Chair Jerome Powell on Thursday.

Oil prices were stable as concerns about oversupply and China’s stimulus plan weighed on the market. Brent crude was at $71.88 a barrel, while US West Texas Intermediate crude edged up to $68.10 a barrel.

Gold prices remained steady at $2,624 per ounce after hitting a one-month low on Monday.

Attribution: Reuters

Subediting: M. S. Salama