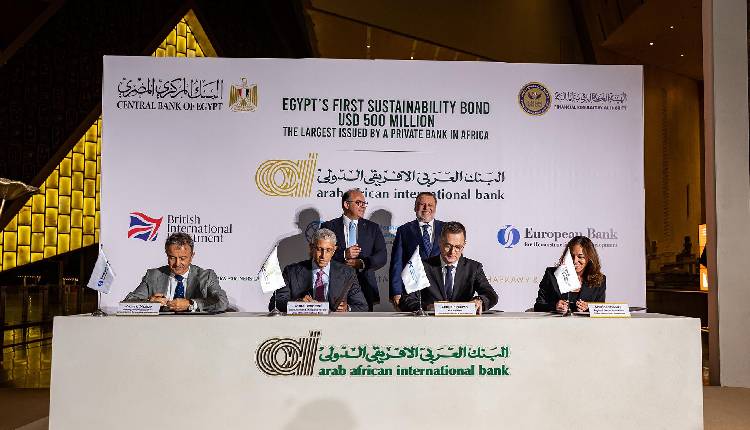

Egypt launched its first sustainability bond, issued by the Arab African International Bank (AAIB), raising $500 million to support green projects and micro, small, and medium-sized enterprises (MSMEs).

The bond, the largest ever issued by a private bank in Africa, attracted investments from the International Finance Corporation (IFC), the European Bank for Reconstruction and Development (EBRD), and British International Investment (BII).

According to EBRD’s statement, 75 per cent of the proceeds will fund green initiatives like renewable energy and energy-efficient industrial projects, while 25 per cent will support social assets, including MSME financing and inclusive finance.

The bond aligns with Egypt’s 2030 climate goal to reduce greenhouse gas emissions by 37 per cent. AAIB’s Vice Chairman Tamer Waheed emphasised the bank’s commitment to integrating sustainability into its core business, positioning it as a leader in environmental and financial innovation.

The investment is seen as a step towards boosting financial inclusion and fostering Egypt’s green transition, with the bond expected to address the country’s growing need for financing sustainable businesses and projects.

Attribution: European Bank for Reconstruction and Development (EBRD)

Subediting: M. S. Salama