Asian stocks declined on Wednesday, and currencies fluctuated as investors were concerned about the potential for imposing further tariffs on other countries under incoming US President Donald Trump.

The unease followed Trump’s announcement of new tariffs on Canada, Mexico, and China. European equities were also expected to weaken, with the Pan-European STOXX 50 futures falling 0.3 per cent.

The Canadian dollar and Mexican peso continued their downward trend after significant drops to multi-year lows on Tuesday. The Chinese yuan edged closer to its recent four-month low.

However, the New Zealand dollar rebounded from its multi-month low after the country’s central bank opted for a 50-basis-point interest rate cut, disappointing some market participants who had anticipated a larger reduction.

The safe-haven Japanese yen strengthened, reaching a two-week high against the US dollar, which was weighed down by falling Treasury yields.

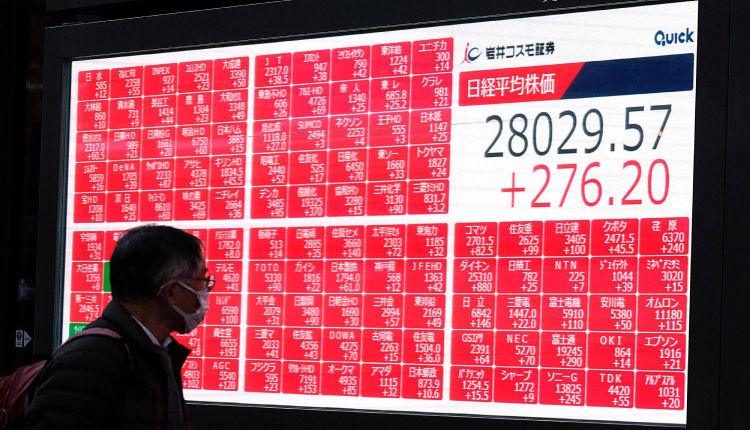

Japan’s Nikkei index declined by over one per cent, with the auto sector suffering the most significant losses due to both tariff threats and a stronger yen.

Taiwanese stocks lost 1.5 per cent, while South Korea’s KOSPI dropped 0.8 per cent. Mainland Chinese blue chips recovered from early losses to rise 0.7 per cent, and Hong Kong’s Hang Seng added 0.5 per cent. MSCI’s broadest index of Asia-Pacific shares dipped 0.3 per cent.

The Chinese yuan weakened 0.1 per cent to 7.2679 per dollar, moving closer to the previous day’s low of 7.2730. The Mexican peso weakened to 20.6980 per dollar, approaching the overnight low of 20.8350. The Canadian dollar also edged lower, but remained above the previous session’s low of C$1.4178.

The US dollar was mixed against other major currencies, rising slightly against the euro and sterling but falling 0.5 per cent against the yen. US short-term Treasury yields declined, extending their pullback from Friday’s nearly four-month peak.

Gold prices rose by 0.3 per cent to around $2,640 per ounce. Oil prices steadied as the market evaluated the ceasefire agreement between Israel and Hezbollah before the OPEC+ meeting on Sunday.

Attribution: Reuters

Subediting: M. S. Salama