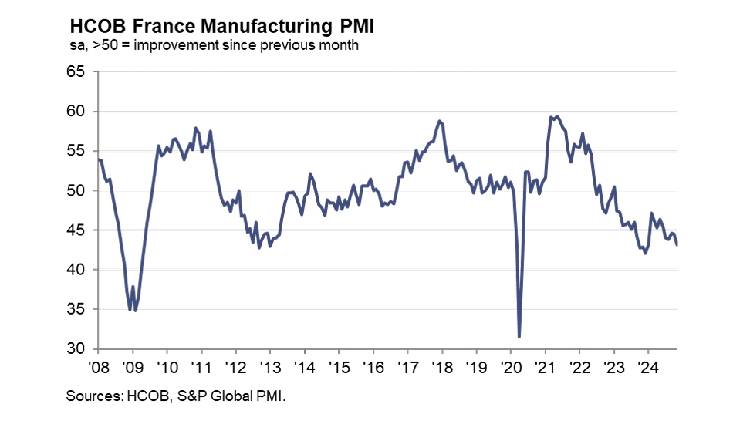

The French manufacturing sector faced a deepening downturn in November, with the HCOB Manufacturing PMI falling to 43.1 from 44.5 in October, marking a twenty-second consecutive month below the 50.0 growth threshold. The decline reflected the steepest drop in new orders since May 2020, driven by weak demand domestically and internationally, particularly from the US and Germany.

Factories responded to the challenging environment by cutting purchasing volumes and reducing inventory levels to preserve cash flow. Employment also declined, with many firms opting not to replace temporary workers, while backlogs of work fell at the fastest pace in over three years.

Despite a modest uptick in input costs, competitive pressures led manufacturers to slash output prices at the greatest rate in over eight years.

Sentiment remained pessimistic, with firms citing uncertainty in the construction and automotive sectors, as well as fragile economic conditions abroad, as key concerns for the coming year.

“France’s industrial sector remains in crisis mode. The HCOB Manufacturing PMI saw a further decline in November, returning to the level seen in January. The year 2024 has failed to meet expectations for a substantial recovery in the industry. Output continues to shrink, and French procurement managers are holding back on inventory purchases. Surveyed companies reported that they are trying to protect their cash flow by reducing inventories.” Tariq Kamal Chaudhry, Economist at Hamburg Commercial Bank, said.

“French manufacturing was also hit by higher costs. Despite the deep crisis, input prices in the French industrial sector rose in November. Compounding the issue, output prices shrank due to competitive pressures, signalling margin erosion.”

Attribution: S&P Global

Subediting: Y.Yasser