European shares extended losses on Thursday after the European Central Bank (ECB) lowered interest rates by 25 basis points, marking its seventh consecutive cut in the past year as it seeks to shore up a weakening eurozone economy.

The ECB’s move — widely expected by markets — reflects growing concerns over sluggish consumption, soft investment, and persistent global trade tensions that continue to weigh on growth across the bloc.

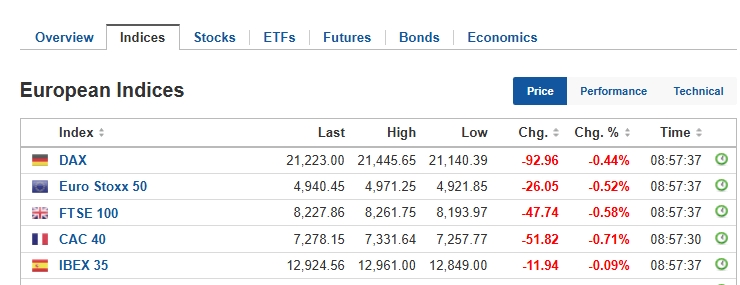

By 12:57 GMT, the pan-European STOXX 600 was down 0.52 per cent, while major regional indices also declined. Germany’s DAX slipped 0.44 per cent, France’s CAC 40 shed 0.71 per cent, the UK’s FTSE 100 fell 0.58 per cent, and Spain’s IBEX 35 edged 0.09 per cent lower.

“This might appear a sensible strategy, given huge uncertainty about future global trade relations. But considering the economic backdrop, there is no need for the ECB to be so hesitant,” said Natasha May, global market analyst at J.P. Morgan Asset Management.

The central bank maintained its data-dependent, meeting-by-meeting approach and said the disinflation process remains intact, signaling a willingness to proceed carefully despite emerging downside risks.

Attribution: Investing.com, Amwal Al Ghad English, Reuters

Subediting: Y.Yasser