Egypt’s external debt rises to $155.1b by end-2024: CBE

Egypt’s external debt reached $155.1 billion at the end of December 2024, up 1.4 per cent from June 2024, driven by higher loan disbursements and a stronger US dollar, the central bank said in its latest external position report.

The increase came as external loan disbursements reached $2.8 billion, while the dollar’s appreciation against other currencies added $600 million to the debt stock, the Central Bank of Egypt (CBE) further explained.

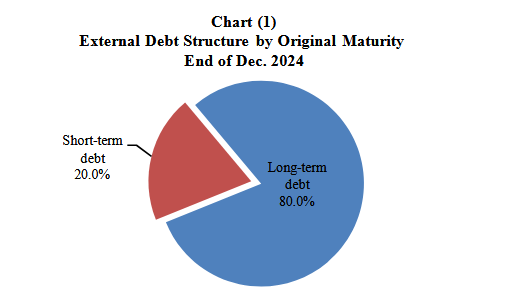

Long-term debt continued to dominate, accounting for $124.1 billion, or 80 per cent of the total, while short-term debt stood at $31.0 billion. By residual maturity, short-term debt was $49.9 billion, compared with $105.2 billion in long-term obligations.

Multilateral institutions remained the largest creditors, holding $49.4 billion, including $15.1 billion owed to the International Monetary Fund (IMF). The World Bank’s IBRD accounted for $12.2 billion, while the European Investment Bank (EIB) and African Development Bank (AfDB) held $4.3 billion and $2.5 billion, respectively.

“The IMF alone represented 30.6 percent of such loans, or the equivalent of US$ 15.1 billion, classified as follows:

– US$ 6.4 billion in Extended Fund Facility (EFF).

– US$ 3.7 billion representing SDR allocation.

– US$ 2.4 billion in Stand-by Arrangement (SBA).

– US$ 0.7 billion in Rapid Financing Instrument (RFI).

– US$ 1.9 billion representing the New Extended Fund Facility.”

Debt owed to Arab countries amounted to $37.7 billion, with Saudi Arabia ($13.9 billion), the United Arab Emirates ($11.3 billion) and Kuwait ($6.0 billion) the top lenders. Paris Club members held $15.8 billion, led by Russia ($4.2 billion), the United States ($3.3 billion) and Japan ($2.6 billion).

Egypt’s bond market liabilities totaled $27.3 billion, including $19.6 billion in U.S. dollar-denominated Eurobonds, $3.9 billion in euro-denominated Eurobonds, $1.4 billion in sukuk, and smaller issuances in yen, yuan and green bonds.

The US dollar remained the primary borrowing currency, making up 67.7 per cent of external debt, or $105 billion. The euro accounted for $18.9 billion, while other major currencies, including Chinese yuan, Japanese yen and Kuwaiti dinar, amounted to $31.2 billion combined.

Attribution: Amwal Al Ghad English