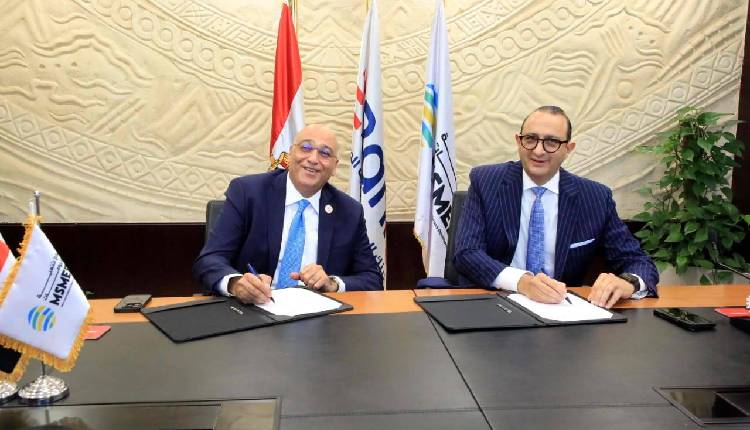

Egypt’s Medium, Small, and Micro Enterprise Development Agency (MSMEDA) and the Export Development Bank of Egypt (EBank) on Thursday signed a cooperation agreement to expand financing and support for small and medium enterprises (SMEs) across the country, with a focus on export growth.

The partnership aims to help entrepreneurs launch new projects, develop existing businesses, and increase exports by leveraging the branch networks of both institutions. Under the agreement, EBank will offer integrated financing, including Egyptian pound loans for working capital and domestic expansion, as well as foreign currency loans—primarily in US dollars—to cover production inputs and export-related operations.

The programme also includes training and awareness initiatives, delivered through EBank’s Export Club, to enhance capabilities in international marketing, brand development, and global market entry.

MSMEDA CEO Basil Rahmi said the collaboration aligns with government directives to open international markets for Egyptian SMEs, particularly industrial projects, and to promote sustainable development and job creation.

Ahmed Galal, CEO and Managing Director of EBank, described the agreement as a “qualitative leap” in enabling SMEs and micro-enterprises to compete in regional and international markets. He added that EBank’s strategy focuses on financial inclusion, sustainable development, and integrating financial and non-financial support to strengthen Egypt’s SME sector.

The agreement also establishes a framework for future cooperation, providing comprehensive financing solutions and specialized training to support exporters nationwide.

Attribution: Amwal Al Ghad English

Subediting: Y.Yasser