Egypt has signed a $140 million long-term financing deal for the first phase of a metallic silicon and derivatives production complex in the New Alamein industrial park, the Ministry of Petroleum said Wednesday. The project is part of the Egyptian Petrochemicals Holding Company (ECHEM).

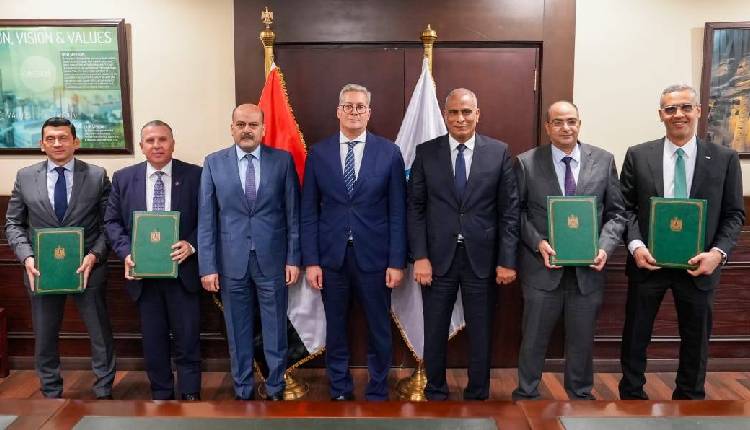

The agreement was signed between Alamein for Silicon Products (ASP) and a banking consortium comprising of QNB Egypt, Commercial International Bank (CIB), and Banque du Caire. The National Bank of Egypt (NBE) will act as the project’s financial advisor.

Petroleum Minister Karim Badawy described the project as a “strategic investment to localise a high-value industry,” generating economic returns and reducing the country’s reliance on imports. He said the ministry plans to expand financing for petrochemical and value-added projects in 2026 to accelerate execution and maximise economic impact.

The first phase targets annual production of 45,000 tons of metallic silicon, with $200 million in investment creating 300 direct jobs and roughly 3,000 indirect roles in logistics, supply chains, and supporting industries. Later phases will include polysilicon production for electronics and solar panels, intermediate silicones, and final products such as silicone rubber and silicone oil.

The project has received a golden licence from the Cabinet, granting unified approval for construction, operation, and permits to fast-track implementation.

The complex aims to leverage Egypt’s ultra-pure quartz resources, strengthen downstream industries, and position the country as a regional hub for silicon-based manufacturing in the Middle East and Africa.

Attribution: Amwal Al Ghad English

Subediting: Y.Yasser