During Wednesday opening session, the Egyptian Exchange (EGX) has posted early losses of EGP 583 million as the capital market has amounted to EGP 351.972 billion, according to data compiled by Amwal Al Ghad at 11:11 a.m. Cairo time (09:11 GMT).

The main index, EGX30 tumbled 0.40% to hit 5090.27 p. EGX20 inched lower 0.30% to reach 5868.3 p.

Meanwhile, the mid- and small-cap index, the EGX70 edged up 0.02% to hit 448.14 p. Price index EGX100 went down by 0.20% to reach 773.57 p.

Traded volume reached 3.614 million securities worth EGP 20.239 million, exchanged through 1.271 transactions.

This was after trading in 73 listed securities; 29 declined 22 advanced while 22 keeping their previous levels.

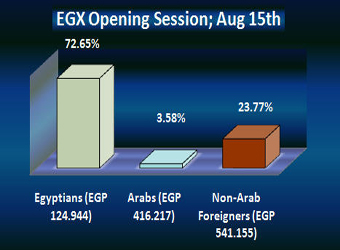

Egyptians and Arabs were net buyers seizing 72.65% and 3.58% respectively, of the total markets, with a net equity of EGP 124.944 thousand and EGP 416.211 thousand excluding the deals.

On the other hand, the main reason behind EGX30’s fall was that non-Arab Foreigners were net sellers seizing 23.77% of the total markets, with a net equity of EGP 541.155 thousand excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during early session.

Orascom Telecom Media & Technology Holding:

Shares of Orascom Telecom Media & Technology Holding (OTMT.CA) led EGX early downwards as they dived by 9.09% to hit EGP 0.50.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) sank by 0.98% to reach EGP 272.90.

Talaat Moustafa Group:

The shares of Talaat Moustafa Group (TMGH.CA) edged down by 0.69% to reach EGP 4.29.

Gehad El Sawafta, Vice Executive Officer of Talaat Moustafa Group Holding SAE (TMGH.CA), announced Sunday that the company has succeeded in selling around 50 % of its commercial malls in Madinaty during May and June with total value of about EGP 500 million.

He added that, the company succeeded in increasing its sales in the first half of 2012 to reach EGP 2.4 billion, compared to EGP 1.1 billion in the first half of 2011.

Furthermore, he pointed out that the company will focus within the coming period to deliver the remaining units.

Citadel Capital:

Shares owned by Citadel Capital (CCAP.CA) inched lower by 0.65% to reach EGP 3.07.

Orascom Telecom Holding:

Shares of Orascom Telecom Holding (OTH) (ORTE.CA) have been suspended.

Orascom Telecom Holding reported second-quarter net profit of $27 million on Tuesday, reversing a loss of $58 million a year earlier when results were weighed down by tax charges from the sale of its Tunisian business.

Earnings before interest, tax, depreciation and amortisation (EBITDA) were $469.8 million, the company said, also revising down its year-earlier figure to $439 million from $476 million.

It said comparative year-earlier figures were restated to reflect the demerger of its units Mobinil, koryolink and Alfa as part of the Vimpelcom tie-up.

Orascom said its EBITDA margin, a broad measure of profitability, was 50.5 percent, up 3.1 percentage points from a year earlier on a like-for-like basis.

EFG-Hermes Holding:

The shares of EFG-Hermes Holding (HRHO.CA) surged by 0.74% to hit EGP 10.93.

EFG-Hermes shareholders meeting is excepted to be reconvened within this week upon the Egyptian Financial Supervisory Authority (EFSA)’s request so as to conclude its deal with QInvest.

Mona Zulficar, EFG-Hermes Board of Directors chairperson, had announced last Tuesday that upon EFSA’s request, EFG-Hermes will be reconvening its shareholders’ annual meeting within a week or a maximum of 10 days.

“During this meeting, we will provide some additional more detailed disclosures on the QInvest deal and the fate of the minority’s rights after signing the deal … we don’t have something to hide behind the scenes.”Zulficar added

Commercial International Bank:

The shares of Commercial International Bank- Egypt (CIB) (COMI.CA) rose by 0.60% to reach EGP 28.60.

Commercial International Bank (CIB) (COMI.CA) reported an 18% increase in second-quarter net income on Tuesday, above the expectations of analysts who say the country’s lenders are benefiting from soaring yields on government debt.

Net profit at the country’s biggest privately owned bank by assets was 523 million Egyptian pounds ($86.17 million), above the 443 million it reported for the same period a year earlier and an analyst consensus forecast of 505 million.

Egypt’s business sector has been struggling to recover from the disruption that followed President Hosni Mubarak’s overthrow last year. Banks such as CIB kept their bottom line growing thanks partly to record-high interest rates paid by the state this year for its short-term borrowing.