Ratings agency Moody’s confirmed on Thursday Egypt’s credit rating at B2 with stable outlook, but warned against its large debt load and persistently weak albeit improving government finances.

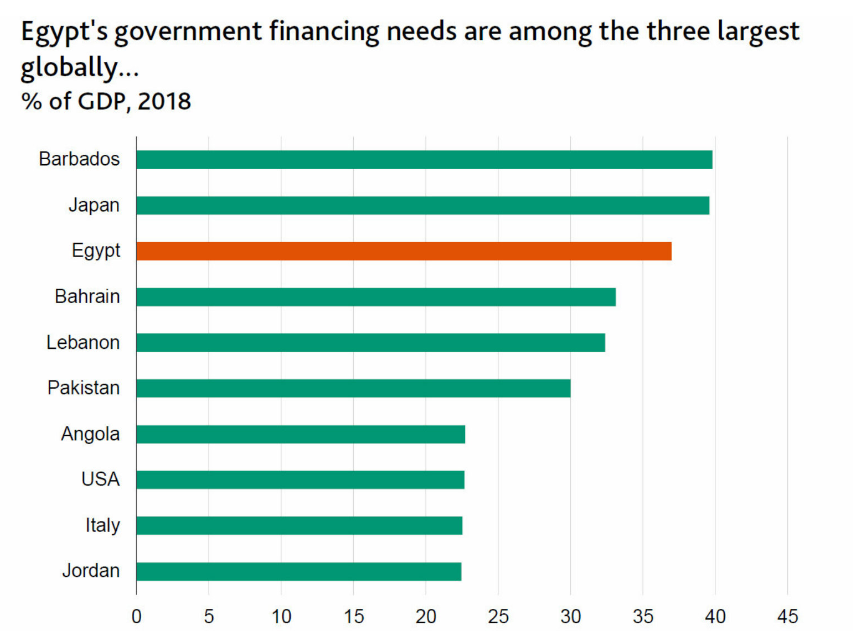

“Despite gradually improving, government finances and its large government financing needs amid high rollover rates expose the sovereign fund to a potential tightening in domestic or external financing conditions.” Moody’s said in its annual report released on August 29.

However, the rating agency expected domestic borrowing costs to gradually decline as the effects of energy price and tariff hikes vanish, allowing the central bank to lower interest rates.

“Egypt’s debt affordability as measured by interest to revenue will remain very weak and financing needs very large in the next few years,” said Moody’s vice president, senior analyst and the report’s co-author Elisa Parisi-Capone.

“Over the longer term, the removal of structural obstacles to a more inclusive, private sector-led growth model will be a gradual process that remains exposed to long-standing vested interests or the risk of reform reversal.”

Egypt will continue to be susceptible to tightening financial conditions, but its declining debt-to-GDP ratio means that it is able to cope with external shocks, the report added.

Moody’s report also shed light on the labour conditions in Egypt, saying that “despite improving labour market conditions, securing jobs for the expanding working age population remains a long-term challenge.

“In addition, domestic political stability has improved, but security risks linger in certain areas, fuelling event risk.”

“The country’s credit strengths include a strong track record of reform implementation and continued reform commitment, its large and diversified economy, a large domestic funding base and replenished foreign exchange reserves.

“Following annual growth of 5.6 percent in FY 2019, Moody’s expects further convergence to 6 percent by 2021.”