African economies hold back from global easing trend

African central banks are set to decide on interest rates in the next three weeks, with most expected to maintain tight monetary policies despite global trends towards easing.

EY Africa Chief Economist Angelika Goliger emphasised the theme of caution and data dependence, with central banks closely monitoring inflation and currency trends.

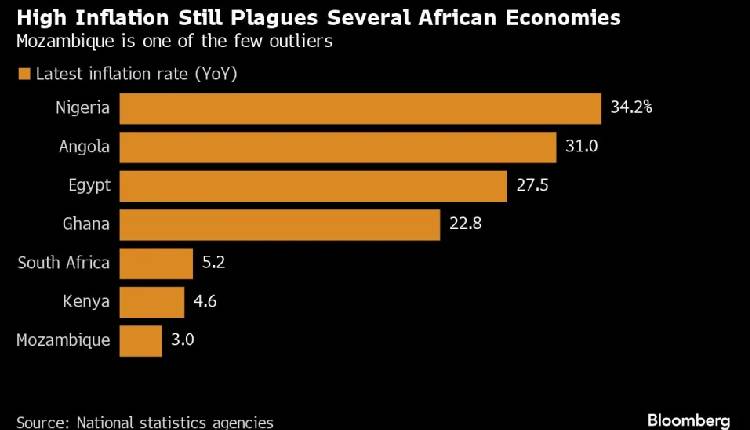

Analysts predict that Nigeria and Angola, sub-Saharan Africa’s largest oil producers, will increase their benchmark rates due to double-digit inflation and weakened local currencies.

South Africa, Egypt, Kenya, and Ghana are forecast to retain their policy rates, while Mozambique is expected to continue lowering borrowing costs.

Currency pressures have heavily impacted Angola, Nigeria, and Ghana, whose currencies have been among the worst performing in Africa this year.

This currency weakness has significantly contributed to inflation, leading Nigeria’s inflation to a nearly three-decade high and Angola’s to a seven-year high.

Ghana’s disinflation process has also been slower than anticipated. Angola doubled the minimum wage to 70,000 kwanza ($79) in June, and Nigeria partially reinstated fuel subsidies, adding pressure on public finances. JPMorgan Chase & Co.’s Gbolahan Taiwo suggests that these factors will likely force central banks to maintain a tighter stance for longer.

Nigeria’s central bank governor, Olayemi Cardoso, has stressed his commitment to taming inflation. South Africa and Egypt are expected to leave their key interest rates unchanged at 8.25 per cent and 27.25 per cent, respectively, due to persistent price pressures.

South African central bank Governor Lesetja Kganyago stated that until inflation sustainably returns to the 4.5 per cent midpoint of its target range, lowering rates will be unlikely. South Africa’s annual inflation rate held at 5.2 per cent in May, above the midpoint for over three years. Egypt’s annual inflation slowed for a fourth consecutive month in June but remained high at 27.5 per cent.

Kenya is also expected to maintain borrowing costs amid ongoing anti-government protests, which have disrupted businesses and renewed currency pressures.

The MPC has introduced US Federal Reserve interest rate decisions as a key risk factor, possibly delaying rate cuts until the US does. Investors expect the Fed to cut rates at least twice this year.

Attribution: Bloomberg.