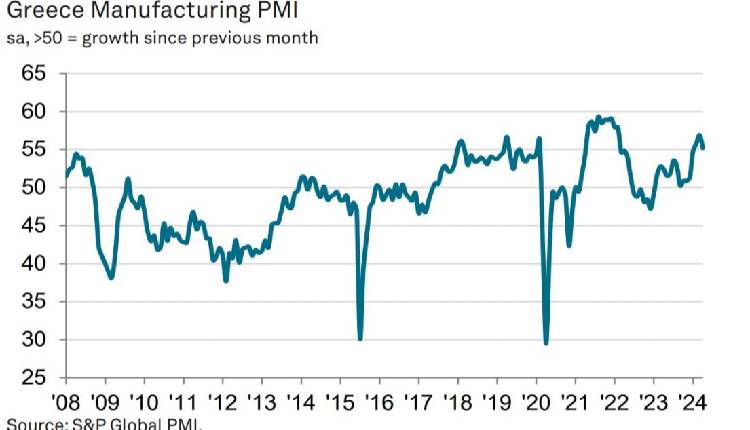

The Greek manufacturing sector experienced a moderate improvement in April, as indicated by the S&P Global Greece Manufacturing PMI, which stood at 52.4 according to a Wednesday report. This figure, although slightly down from March’s 52.8, marks the second-fastest growth in nearly a year.

The sector’s growth was propelled by a quicker expansion in new orders, which rose at the fastest rate since January 2022. This surge in new sales was supported by stronger demand from existing clients and a reduction in competition.

Employment also saw a significant boost, with job creation accelerating to the fastest pace in a year. This uptick in hiring reflects manufacturers’ increased confidence in the sector’s outlook over the coming year.

Moreover, the report highlighted a softening of inflationary pressures, with the rate of cost increases easing to the slowest since July 2020. This deceleration in costs has also led to a moderation in selling price inflation.

Despite challenges in foreign demand, the overall sentiment remains positive, with output expectations reaching their highest since early 2022.

Economist Siân Jones from IHS Markit commented on the data, highlighting the continued growth amid improved client demand both domestically and internationally. However, she also noted the intensifying inflationary pressures, exacerbated by supply chain disruptions and rising raw material costs.

“The Greek manufacturing sector remained in good health at the start of the second quarter, as a sustained and strong upturn in new orders supported output growth. Although softer that seen in the preceding two survey periods, rates of expansion were historically robust. Meanwhile, foreign client demand strengthened.” Jones noted.

“The sector continued to be hampered by delays to input deliveries following a redirection of supply routes away from the Suez Canal. Longer lead times for raw materials and an accelerated uptick in input costs stymied efforts to replenish stocks. The sharpest rise in cost burdens since early-2023 led firms to hike selling prices at a quicker pace.”