Asian shares were subdued on Wednesday as investors awaited key US inflation data and the Federal Reserve policy decision. The data will set the near-term course for interest rates.

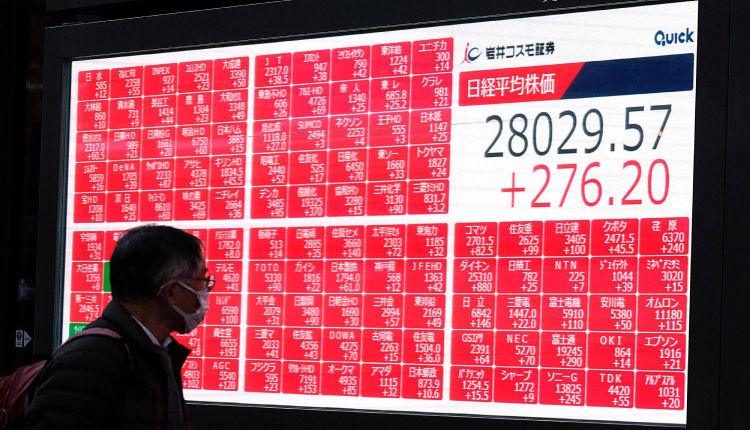

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1 per cent, while Japan’s Nikkei fell 0.8 per cent. However, technology shares in the region were up, with the MSCI Asia-Pacific ex-Japan IT index rising one per cent.

China’s consumer price index fell 0.1 per cent in May from a month earlier, missing forecasts. On an annual basis, it rose a meagre 0.3 per cent.

Chinese blue chips were down 0.1 per cent, while Hong Kong’s Hang Seng index extended losses to 1.2 per cent. The decline was also fuelled by a 27 per cent plunge in China Evergrande New Energy Vehicle Group after the unit warned of losing assets.

Overnight on Wall Street, Applesurged seven per cent to a record high after unveiling new AI features for iPhones. This helped the Nasdaq Composite rise 0.9 per cent and the S&P 500 gain 0.3 per cent to record closing highs.

The positive sentiment lifted tech-heavy Taiwan and South Korean shares, which gained 0.7 per cent and 0.3 per cent, respectively.

Elsewhere, caution reigned as focus shifted to the US CPI data expected later in the day. The forecast predicts a slight increase of 0.1 per cent in May compared to the previous month, with the core index rising 0.3 per cent.

S&P 500 futures and Nasdaq futures remained flat in Asian trading. Market participants adopted a risk-management approach, anticipating potential selling based on the CPI data.

The dollar index held firm at 105.31 against its major peers, maintaining all its gains since the US payrolls report on Friday.

The euro continued its decline for a fourth consecutive session, trading at $1.0734 amid political turmoil in Europe.

Treasury yields steadied after falling overnight on the robust result of a 10-year Treasury auction. The 10-year yield remained at 4.4099 per cent.

Oil prices extended their gains for a third straight session, with Brent futures rising 0.2 per cent to $83.11 a barrel and US crude futures gaining 0.4 per cent to $78.19 a barrel. Gold prices edged slightly lower to $2,311.80 per ounce.

Attribution: Reuters