Asian stocks fell and the the ICE US Dollar Index jumped on Thursday to trade near 108.20,its highest since Nov. 11, 2022, on the back of the US Federal Reserve’s announcement of a slower pace of rate cuts next year.

The yen also weakened after the Bank of Japan maintained its interest rates.

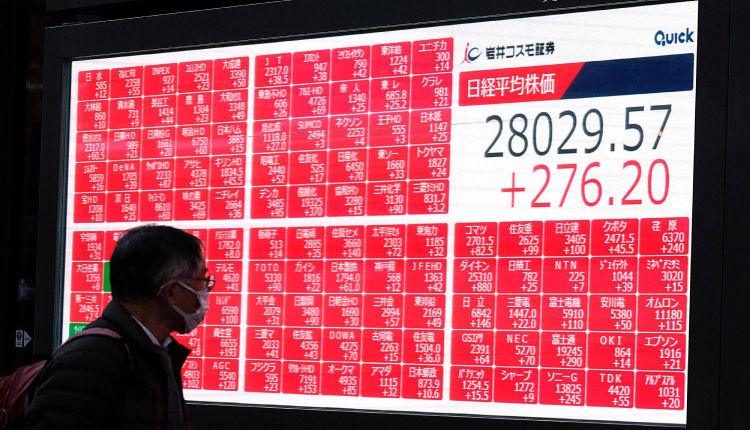

The Fed’s hawkish stance led to a decline on Wall Street, which then impacted Asian stocks on Thursday. The MSCI Asia-Pacific index outside Japan slid 1.6 per cent. Taiwan stocks fell 1.2 per cent, while Australian shares slid by almost 2 per cent.

As anticipated, the yen hit a one-month low of 155.48 against the dollar following the BOJ’s decision to keep rates unchanged. It was trading around 155.3 to the dollar, close to the lower end of its range this year due to a strong dollar and a significant interest rate gap.

Bitcoin briefly dropped below the $100,000 mark in the cryptocurrency market following Powell’s statement that the US central bank has no interest in participating in any government initiative to accumulate significant amounts of bitcoin.

Gold prices rose 0.8 per cent to $2,609 per ounce, while oil prices declined due to worries about demand.

Attribution: Reuters, Amwal Al Ghad English

Subediting: M. S. Salama