Asian stock markets experienced a decline on Tuesday as investors grappled with the anticipation of imminent US interest rate cuts and eagerly awaited the earnings report from AI pioneer Nvidia.

Simultaneously, escalating tensions in the Middle East and supply concerns dampened risk sentiment, bolstering oil prices.

Gold prices hovered near a record high, while the dollar and the Japanese yen remained relatively steady. Investors sought safe havens amidst geopolitical risks, exacerbated by the recent exchange of fire between Israel and Lebanon’s Hezbollah.

Crude oil prices were further supported by Libya’s decision to halt oil production and exports following a shutdown of all oil fields by the eastern-based government.

Investor sentiment was heightened as the market eagerly awaited Nvidia’s earnings report on Wednesday. Any deviation from a stellar forecast could potentially disrupt the AI-fuelled rally.

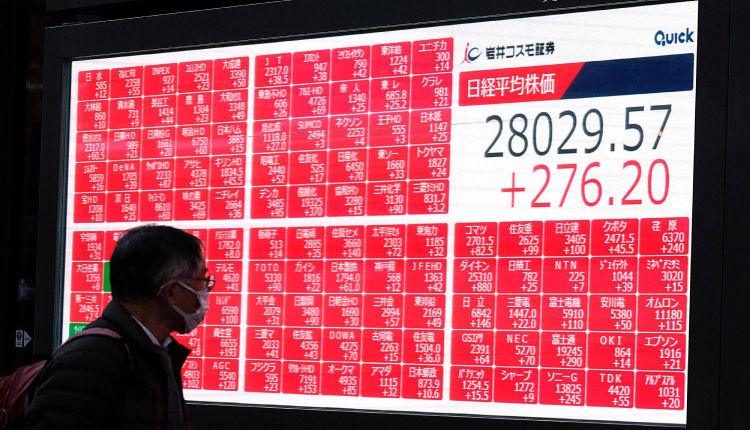

MSCI’s broadest index of Asia-Pacific shares outside Japan retreated by 0.48 per cent, slightly pulling back from its one-month high reached in the previous session.

European markets were poised for a modest opening, with Eurostoxx 50 futures indicating a slight uptick.

China’s blue-chip index, CSI300, experienced a 0.61 per cent decline, while Hong Kong’s Hang Seng index slipped by 0.27 per cent.

Lackluster earnings from Temu-parent PDD Holdings, attributed to lower consumer spending, weighed on sentiment.

Canada’s decision to impose tariffs on imports of Chinese electric vehicles, steel, and aluminium, mirroring similar moves by the United States and European Union, further impacted market sentiment.

The Japanese yen remained relatively strong, trading at 144.645 per dollar. The dollar index, measuring the US currency against six major rivals, held steady near a 13-month low.

Oil prices experienced a slight pullback on Tuesday after a significant surge in the previous session, driven by supply concerns arising from Middle East tensions and Libyan production cuts. Brent crude futures declined by 0.21 per cent, while US crude futures eased by 0.32 per cent.

Gold prices dropped by 0.39 per cent to $2,507.12 per ounce on Tuesday, slightly below the record high of $2,531.60 set on Aug. 20.

Attribution: Reuters

Subediting: M. S. Salama