Aston Martin in negotiations over $1.4 bln debt

Aston Martin Lagonda Global Holdings Plc, whose near-term liabilities total about $1.4 billion, is negotiating with bankers to address an impending debt pile, according to Bloomberg citing the company’s Executive Chairman Lawrence Stroll.

The British luxury carmaker, which is incurring losses, has raised capital several times, most notably from new significant shareholders.

It is attempting to refinance amid a volatile debt market due to concerns about potential rate reductions.

The subject of discussion will be a $1.1 billion bond that matures in November of next year and requires payments from the company totaling $120 million a year at a 10.5 per cent coupon.

“We are currently studying with our bankers the most appropriate actions of how to deal with it,” Stroll stated in an interview with Bloomberg Television. “Obviously it will be addressed in the most appropriate manner possible and in the best interests of the company and its shareholders.” He added.

According to data gathered by Bloomberg, Aston Martin also has a $121 million note that is due in 2026 and a revolving credit facility worth £79 million ($99.8 million) that is due next year.

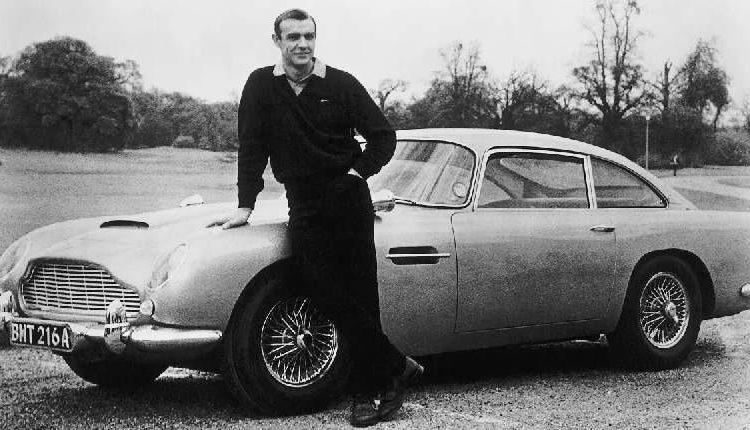

2020 saw the rescue of the company best known for the sports cars that starred in the James Bond film series by Stroll, a Canadian billionaire. Due to the company’s ongoing financial difficulties, Stroll enlisted the help of Saudi Arabia’s Public Investment Fund in 2022 to help with its turnaround efforts and shift to battery-powered sports cars.

Notably, Aston Martin has historically been deemed vulnerable by analysts due to its small size and unstable cash balance.

Last year, after electric vehicle manufacturer Lucid Group Inc., where Saudi Arabia’s PIF holds a majority stake, Chinese Zhejiang Geely Holding Group Co Ltd. surpassed it as the company’s third-largest shareholder.

In a note, Bloomberg Intelligence analyst Joel Levington stated that Aston Martin is confronted with the “daunting task of generating an operating profit for the first time in six years while considering alternatives to restructure its highly leveraged balance sheet.”

According to Levington, the company, responsible for creating the supercar Valkyrie, may also strengthen its connections with Geely’s stable of brands, which also includes premium EV manufacturer Polestar and the former British sports car company Lotus.

Following supply-chain problems that delayed the launch of its new DB12 sports car, the company issued a warning in November stating that it expects to ship fewer vehicles than previously projected for the entire year. On February 28, it will report full-year earnings.

When questioned about remarks made by analysts suggesting that Aston Martin might be open to a takeover offer from its new owners, Stroll stated that the business was “not in any M&A territory.”