Australia’s central bank considered raising interest rates at its May policy meeting but ultimately decided to keep the key rate at 4.35 per cent, citing the need to avoid “excessive fine-tuning,” Bloomberg reported on Tuesday.

Minutes from the May 6-7 meeting revealed the board discussed two options, noting balanced economic risks despite stronger-than-expected data.

The board emphasised looking beyond short-term inflation variations, with economist Belinda Allen suggesting a high hurdle for further hikes.

The minutes reinforced expectations of prolonged high rates, with government bonds declining and three-year yields rising for the third consecutive day. Swaps traders anticipate the RBA holding rates until mid-2025.

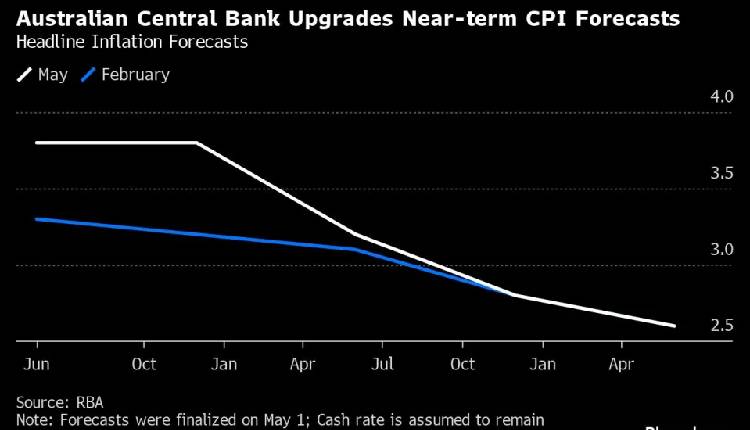

The central bank updated near-term inflation forecasts, expecting consumer prices to hit the 2-3 per cent target by late 2025, up from 3.6 per cent in early 2024.

The minutes indicated limited tolerance for inflation returning to target later than 2026. ANZ Bank’s Adam Boyton suggested the RBA might tolerate higher prices longer than expected, though he predicts a modest easing cycle with three cuts starting in November.

Governor Michele Bullock has indicated cuts could occur before inflation hits the target band, but she has pushed back against near-term easing speculation.

Data shows Australia’s economy is slowing, with GDP contracting on a per person basis and weak retail sales. A private report indicated lower consumer confidence due to inflation concerns, though a resilient labour market gives policymakers hope for a soft landing.