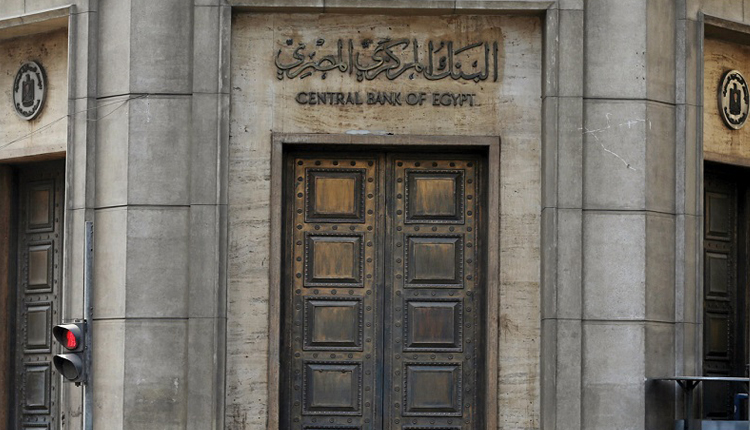

Egypt’s central bank kept interest rates unchanged as expected on Thursday, following sharp increases in fuel and electricity prices that are expected to edge inflation upwards.

The Monetary Policy Committee (MPC) decided to keep the Central Bank of Egypt’s (CBE) overnight deposit rate, overnight lending rate, and the rate of the main operation unchanged at 16.75 percent, 17.75 percent, and 17.25 percent, respectively. The discount rate was also kept unchanged at 17.25 percent.

Annual headline and core inflation continued to decline since August 2017, recording in May 2018, the lowest level since April 2016 at 11.4 and 11.1 percent, respectively. Unemployment also continued to decline, recording in the first quarter of 2018, the lowest rate since the fourth quarter of 2010 at 10.6 percent.

Supported by foreign and domestic public investment demand, annual real GDP growth exhibited sustained increases since the fourth quarter of 2016, recording in the first quarter of 2018 a preliminary estimate of 5.4 percent.

The bank said the global financial conditions tightened, and oil prices rose, putting upward pressure on the magnitude of domestic fiscal consolidation.

“The Ministry of Finance is targeting to achieve a primary balance surplus in the magnitude of 0.2 percent of GDP in fiscal year 2017/18 and 2.0 percent over the following fiscal years.” it said in a statement.

Fiscal consolidation measures are expected to lead to one-off increases in the price level, which translate into temporary higher inflation rates, it added.

“Yet, as the recently implemented measures were anticipated, average annual headline inflation is expected to remain in line with the CBE’s target announced in May 2017, namely 13 percent (±3 percent) in 2018 Q4.”

Single digit inflation is expected to be reached after the temporary effect of supply shocks dissipates, the bank added.

“The setting of policy rates in previous MPC meetings has been consistent with this outlook. Accordingly, the MPC decided that keeping key policy rates unchanged remains consistent with achieving the targeted disinflation path.”

“The MPC closely monitors all economic developments and will not hesitate to adjust its stance to achieve its mandate of price stability over the medium term,”