Egypt’s central bank kept its key interest rates unchanged on Thursday, refraining from further monetary tightening following a slight cooling in inflation in April.

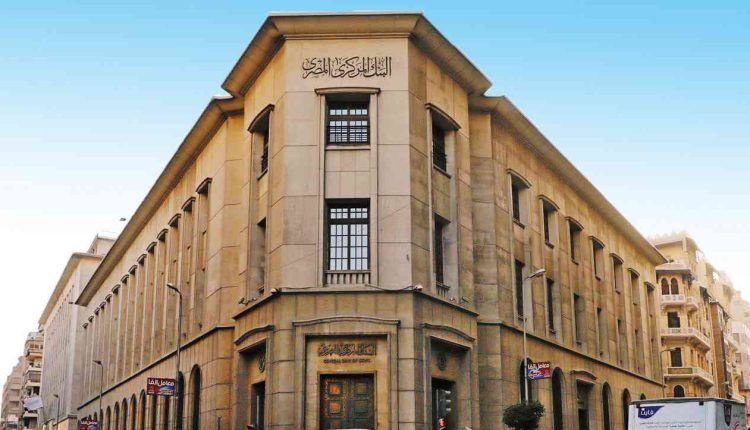

The Central Bank of Egypt’s (CBE) Monetary Policy Committee (MPC) decided to keep the overnight deposit rate, overnight lending rate, and the rate of the main operation on hold at 18.25 percent, 19.25 percent, and 18.75 percent, respectively, it said in a statement.

The CBE also kept its discount rate unchanged at 18.75 percent.

The inflation rate climbed from under 6 percent in 2021 to almost 33 percent in March this year, partly due to the Russian war in Ukraine that led to a spike in wheat and food prices. However, it eased for the first time in 10 months in April, to 30.6 percent.

Egypt, one of the world’s biggest wheat importers, was particularly vulnerable when the Russian war roiled commodity markets. The country has devalued the pound three times since March 2022 and secured a $3 billion International Monetary Fund (IMF) deal.

“On the global front, forecasts for key international commodity prices have been revised downwards compared to those underlying the previous MPC meeting. Global inflationary pressures have also eased as a result of a mix of factors, most notably the monetary policy tightening on the part of major central banks, the declining energy prices, and a reduction in global supply bottlenecks. Similarly, forecasts for economic growth have broadly stabilized, while volatility in financial conditions of key advanced economies has eased compared to the previous MPC meeting.” the MPC statement read.

Domestically, the central bank said the growth of real economic activity eased to 3.9 percent in the fourth quarter of 2022 compared to 4.4 percent in the third quarter of 2022, indicating that growth during the first half of financial year 2022/23 registered 4.2 percent. Detailed sectoral data for the third quarter of 2022 show that growth “was primarily driven by private sector economic activity, specifically tourism, agriculture and trade.”

“Additionally, most leading indicators point towards a slowdown of real GDP growth in 2023 Q1. In line with the early signs of economic activity slowdown, broad money (M2) and its local currency components grew at a slower pace in March 2023. Going forward, real GDP growth is expected to slowdown in fiscal year 2022/23 compared to the previous fiscal year, before recovering thereafter. Meanwhile, the unemployment rate recorded 7.2 percent in 2022 Q4, down from 7.4 percent in the preceding quarter. This was mainly attributed to an increase in employment compared to the previous quarter.”

The MPC further stated: “Annual urban headline inflation decelerated to record 30.6 percent in April 2023, compared to 32.7 percent in March 2023, marking the first deceleration since June 2022. Meanwhile, annual core inflation decelerated for the second consecutive month in April 2023 to record 38.6 percent, breaking its upward trend that lasted since mid 2021. The recent deceleration in both annual headline and core inflation is primarily attributed to favorable base effects as well as the ease of major inflationary shocks; such as the domestic supply chain disruptions that affected main core food commodities and the repercussions of the exchange rate developments.”

“Economic developments following the last MPC meeting were broadly in line with expectations. The MPC continues to assess the impact of the cumulative policy rate hikes of 1000 bps since March 2022 in addition to the 400 bps increase in the required reserve ratio in September 2022, to contain inflationary pressures in a data-driven manner. In light of the above, the MPC decided to keep policy rates unchanged.”