CBE’s Hassan Abdalla: Anchoring inflation expectations is key

Hassan Abdalla, Governor of the Central Bank of Egypt (CBE), emphasised on Wednesday the importance of managing inflation expectations, improving policy effectiveness, and social considerations in order to achieve macroeconomic stability.

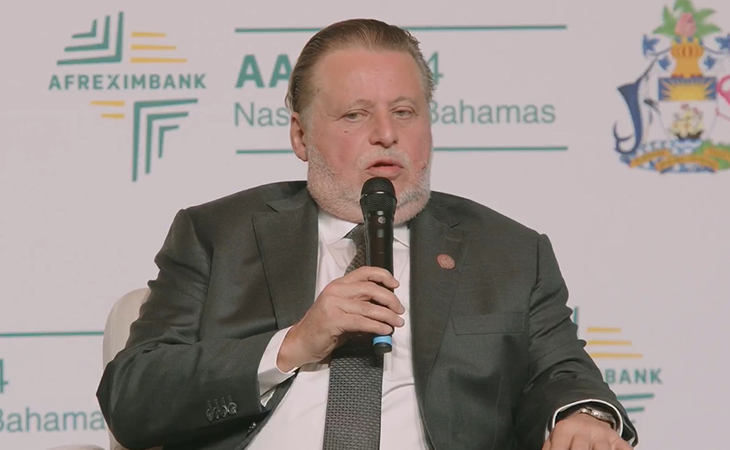

At the African Export-Import Bank‘s (Afreximbank) Annual Meetings (AAM) in Nassau, Bahamas, Abdalla took part in a panel discussion focused on navigating economic crises.

Moderated by Aloysius Uche Ordu of the Brookings Institution, the session featured insights from Governor Abdallah, Ken Ofori-Attah, Economic Advisor to the President of Ghana; and Chad Blackman, Minister of Economic Affairs and Investment of Barbados.

Abdalla elaborated on the specific challenges faced by Egypt. The North African nation, burdened by debt repayments and rising interest rates, was particularly susceptible to these global issues. He emphasised two key threats; the inflationary expectations and the foreign currency shortage. He stressed the danger of inflated expectations of future inflation. This phenomenon, he explained, creates a vicious cycle as it discourages investment and weakens the local currency.

“And I believe that inflation is … the one disease that each country has to focus on. And what happened in Egypt, the increase that when you have higher inflation. And more important than inflation, which is a point that I want to make, is the expectation for inflation, which has been very … high and … it feeds on itself. It leads to negative real rate of return, which in turn leads to asset purchases and becomes a vicious circle.”

He referred that Egypt’s reliance on foreign currency for essential goods was further exacerbated by the flight of local currency seeking stability. This created a shortage of foreign currency reserves.

“Egypt specifically one of the most assets that are recipient of this local money is the foreign currency. So, this leads to exaggerating the problem more, having a foreign currency shortage.

Strengthening Transmission Mechanisms

Abdalla highlighted the need for improved “transmission mechanisms” – the channels through which central bank policies affect the real economy. He cited Egypt’s use of increased reserve requirements as an example of a faster-acting tool to manage liquidity.

Credibility and a “Full Package” Approach

Restoring market confidence requires demonstrably decisive action, Abdalla argued. He advocated for a “full package” of solutions that address not just inflation but also currency shortages, the business environment, and social safety nets. He expressed pride in Egypt’s existing social programmes – such as Takaful and Karama – aimed at vulnerable populations and their ongoing efforts towards improved targeting.

Combating Currency Weakness and Inflation:

The CBE governor acknowledged the challenges posed by a strong US dollar and weak local currencies in many African nations. He argued that a focus on value-added exports, rather than raw materials, is crucial for strengthening African currencies. He even underscored the importance of combating inflation, noting the negative impact of high inflation expectations on economies.

Harnessing Africa’s Potential for Growth:

The discussion also explored broader opportunities for African nations. Ordu, the moderator, highlighted the potential for Africa to achieve significant economic growth, citing the continent’s young population and technological advancements. Governor Abdalla identified financing, technology transfer, and education as key areas for improvement to unlock this potential. He commended Afreximbank’s focus on facilitating intra-African trade and investment as a positive step in this direction.

Ongoing Challenges faced by Global Financial System

“The geopolitical tensions are adding to it. The post-COVID was very severe and the inflation is quite high now that’s was almost affected almost all countries. Egypt, we had more than our share because we also were caught at the time where we had a lot of debt repayments and with interest rates going up and risk premium as well going up, this puts a drain on the cash flow. And more important, inflation.”

Abdalla addressed the ongoing struggles faced by the global financial system. He highlighted a confluence of factors creating a complex economic environment. He pointed to a cycle of crises, including geopolitical tensions and the lingering effects of the COVID-19 pandemic, as major contributors to the current difficulties. These factors, he argued, have led to concerningly high inflation rates in many countries, impacting global financial stability.