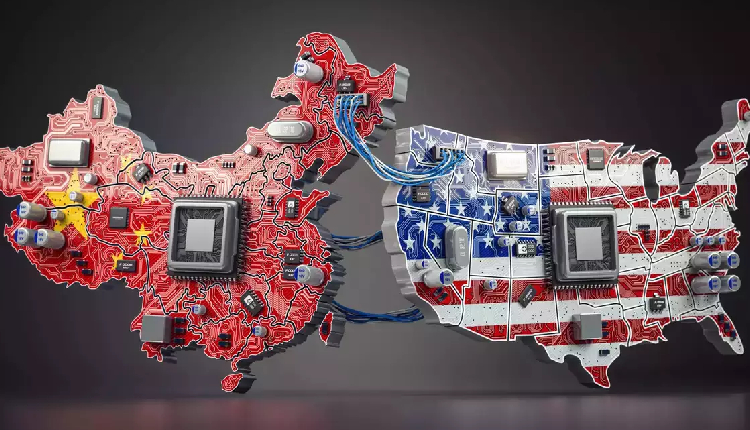

China pushes chip self-sufficiency, squeezing US suppliers

Chinese chipmakers are ramping up efforts to source materials and chemicals domestically, aiming to reduce reliance on foreign suppliers amid tightening US export controls, the Nikkei Asia reported on Tuesday.

Semiconductor Manufacturing International Corporation (SMIC), China’s top contract chipmaker, is encouraging customers to use local suppliers for wafers, chemicals, and gases in chip production. This push has been growing since 2023.

Similarly, ChangXin Memory Technologies (CXMT), a top DRAM manufacturer, is actively vetting domestic alternatives, citing national policy directives.

SMIC’s addition to the US Entity List in 2020 led to a focus on sourcing from domestic suppliers to maintain production. The current effort extends beyond chipmaking equipment affected by US regulations to include hundreds of vital materials.

Chipmakers are being encouraged to switch suppliers by China, offering incentives to speed up the process. Local suppliers have more chances to qualify, and chipmakers using domestic materials receive financial credits.

The goal is to replace foreign suppliers with viable local alternatives, driven by stricter US export controls, according to a source familiar to the matter.

Chipmakers maintain ties with foreign suppliers to ensure production quality, but incentives are driving opportunities for Chinese material suppliers like National Silicon Industry Group to compete with industry giants like Shin-Etsu Chemical.

China is also increasing domestic sourcing of critical materials like sputter targets and polishing slurries, previously dominated by foreign companies like 3M and DuPont.