ECB should favour QE in Crisis – Schnabel

The European Central Bank (ECB) should primarily utilise quantitative easing programmes during periods of crisis due to the potentially more significant costs compared to other tools it has, said Isabel Schnabel, an Executive Board member of the ECB, cited by Bloomberg on Tuesday.

Speaking in Tokyo on Tuesday, Schnabel highlighted that while asset purchases can be effective during market crises, their costs might outweigh their benefits in calmer times.

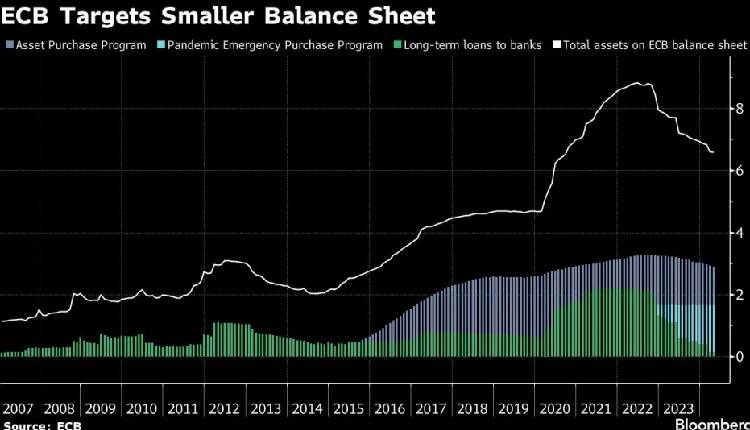

The ECB initiated large-scale asset purchases in 2015 to address slow inflation, with holdings peaking at about €5 trillion ($5.4 trillion), mainly in government debt.

However, policymakers began rolling off assets in 2023 alongside interest rate hikes to manage rising prices, a trend expected to accelerate mid-year with the conclusion of reinvestments from pandemic-related holdings.

Looking ahead, the ECB is set to undergo a review of its monetary policy strategy next year, potentially including a reassessment of its QE approach.

Schnabel underscored the importance of targeted and parsimonious use of asset purchases, citing examples like the ECB’s commercial paper purchases in 2020.

She also highlighted the efficacy of measures such as targeted longer-term refinancing operations in supporting the economy while minimising long-term effects, particularly in a bank-based economy like the euro area.