The Egyptian Exchange (EGX) has ended Wednesday’s session posting losses of EGP 3.57 billion driven by foreign selling pressures amid announcing Egypt’s foreign reserves recent data. The capital market has reached to EGP 382.944 billion.

Egypt’s central bank said on Tuesday foreign reserves dropped almost 10 percent in January to $13.6 billion.

The EGX indices closed in red.

The main index, EGX30 pushed down by 1.81% to end at 5690.93 p. EGX20 tumbled by 1.33% to close 6615.39 p.

Meanwhile, the mid- and small-cap index, the EGX70 inched down by 0.21% to conclude at 481.8 pts. Price index EGX100 fell by 0.61% to finish at 810.71 p.

During Wednesday’s closing, the trading volume has reached 251.397 million securities worth EGP 576.259 million, exchanged 29.230 thousand transactions.

This was after trading in 174 listed securities; 116 declined, 32 advanced; while 26 keeping their previous levels.

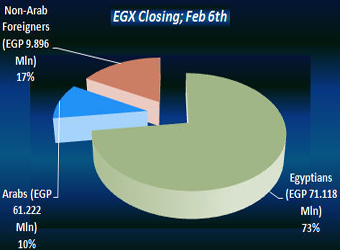

EGX’s closing losses were driven by Arabs and non-Arab foreigners’ selling pressures as they were net sellers seizing 10.35% and 16.79% respectively, of the total markets, with a net equity of EGP 61.222 million and EGP 9.896 million excluding the deals.

Meanwhile, Egyptians were net buyers seizing 72.87% of the total markets, with a net equity of EGP 71.118 million excluding the deals.