During Monday opening session, the Egyptian Exchange (EGX) has posted early losses of around EGP 3 billion as the capital market has amounted to EGP 347.461 billion, according to data compiled by Amwal Al Ghad at 11:06 a.m. Cairo time (09:06 GMT).

The EGX indices opened in red.

The main index, EGX30 sank by 1.76% to 4963.03 p. EGX20 pushed down by 1.48% to 5689.38 p.

Meanwhile, the mid- and small-cap index, the EGX70 dropped by 0.29% to 437.34 p. Price index EGX100 inched lower by 0.80% to 734.62 p.

This was after trading in 84 listed securities; 59 declined, 3 advanced; while 22 keeping their previous levels.

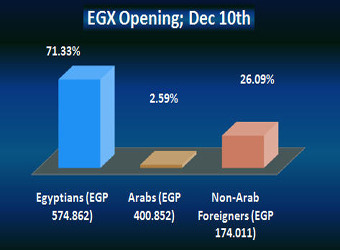

The non non-Arab foreigners and Arabs’ opening selling transactions have driven EGX’s opening losses as they were net sellers 26.09% and 2.59% respectively, of the total markets, with a net equity of EGP 174.011 thousand and EGP 400.852 thousand excluding the deals.

On the other hand, Egyptians were net buyers seizing 71.33% of the total markets, with a net equity of EGP 574.862 thousand excluding the deals.

Egypt President Mohamed Morsi has retracted his Sunday decisions to increase tax burdens on the Egyptian people, and ordered the government to carry out a “social dialogue” on the measures before implementation.

In a statement issued on his official Facebook page at around 2 am on Monday, Morsi said he had put on hold the measures of raising sales taxes on a wide range of consumer goods and services that were made public Sunday afternoon.

“[The President] does not accept that the Egyptian citizen carries any extra burdens without consent. His Excellency has decided to halt the [tax raising] decisions until the degree of public acceptance is made clear,” the statement read.

The measures represent the implementation of an economic programe that Egypt has proposed to the International Monetary Fund (IMF) in order to be eligible for a $4.8 billion loan. They are aimed at reducing public deficit through increasing state revenue.