During Tuesday opening session, the Egyptian Exchange (EGX) has posted losses of EGP 3.75 billion as the capital market has amounted to EGP 369.671 million , according to data compiled by Amwal Al Ghad at 11:01 a.m. Cairo time (09:01 GMT).

The EGX indices opened in dark red.

The main index, EGX30 pushed down by 1.78% to 5317.44 p. EGX20 dived 2.23% to 6061.49 p.

Meanwhile, the mid- and small-cap index, the EGX70 edged down by 1.50% to 478.14 pts. Price index EGX100 fell by 1.59% to 798.81 p.

Due to the mounting death toll in Gaza as well as the current tensions in Mohamed Mahmoud street in Tahrir and the vague vision regarding the making of the country’s new constitution, the investors seem that they lost their appetite.

Ashraf Abdel-Aziz, head of institutional sales at Cairo-based Arabeya Securities, said the Egyptian market had also suffered from Saturday’s road/rail collision in the Upper Egyptian Assiut Governorate in which more than 50 children were killed.

There are calls for the dismissal of the country’s current government led by Dr. Hisham Kandil amid Assiut fatal train-bus accident.

It is worth noting that in Two sessions (Sunday & Monday), the EGX has incurred losses of around EGP 14.4 billion; while the benchmark has tumbled by 4.4%.

Traded volume reached 8.436 million securities worth EGP 11.549 million, exchanged 997 thousand transactions.

This was after trading in 89 listed securities; 58 declined; while 31 keeping their previous levels.

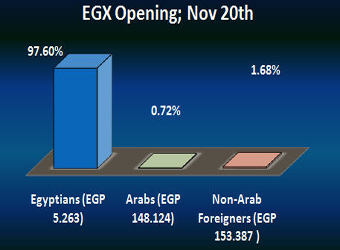

EGX’s early losses were driven once again by the non-Arab Foreigners’ selling pressures.

Egyptians and Arabs were net buyers seizing 97.6% and 0.72% respectively, of the total markets, with a net equity of EGP 5.263 thousand and EGP 148.124 thousand excluding the deals.

On the other hand, the non-Arab Foreigners were net sellers seizing 1.68% of the total markets, with a net equity of EGP 153.387 thousand excluding the deals.

EGX’s main shares witnessed downwards amid the current developments including Israel’s recent shelling of Gaza.

Citadel Capital (CCAP.CA)’s stock sank by 3.61% to EGP 3.47.

EFG-Hermes Holding (HRHO.CA) dived by 2.21% to EGP 10.62. The investment bank has reported on Monday a 9-month consolidated net profit of EGP 232.089 million, 19% down from a net profit of EGP 286.014 million for the same period a year earlier.

Orascom Construction Industries – OCI (OCIC.CA)’s stock fell by 2.02% to EGP 246.00. OCI announced that its wholly owned subsidiary, Iowa Fertilizer Company (IFCo), held a groundbreaking ceremony to mark the start of construction work on its new greenfield nitrogen fertilizer production plant in Wever, Iowa. IFCo will be the first world scale natural gas-based fertilizer plant built in the United States in nearly 25 years and will help reduce the United States’ dependency upon imported fertilizers.

Orascom Telecom Media & Technology Holding (OTMT.CA)’s stock edged down by 1.75% to EGP 0.56.

Orascom Telecom Holding (OTH) (ORTE.CA) dropped 1.13% to EGP 3.49. Weather Investments, chaired by Egyptian telecoms magnate Naguib Sawiris, launched its $5 billion claim on Monday against Algeria for allegedly inflicting damages to stakes it owned in the Egyptian Orascom Telecom Algerie, most popularly known as Djezzy.

‘The Algerian Government committed to a number of protections, including a promise to refrain from arbitrary interference in our operations, but has since 2008 pursued a campaign of interference and harassment which has cost Weather Investments over $5 billion in damages,’ Sawiris said in a statement.