During Monday midday session, the Egyptian Exchange (EGX) has posted minor losses of EGP 391 million as the capital market has amounted to EGP 377.380 million , according to data compiled by Amwal Al Ghad at 12:58 p.m. Cairo time (10:58 GMT).

The EGX indices traded mixed.

The main index, EGX30 went up by 0.03% to 5479.99 p. EGX30 retreated on Sunday 3..3%, the most since July 9. EGX20 rose by 0.20% to 6297.44 p.

Meanwhile, the mid- and small-cap index, the EGX70 edged down by 0.47% to 495.17 pts. Price index EGX100 fell by 0.29% to 825.04 p.

The Egyptian Exchange administration had on Sunday held one-minute silence for the children killed in Assiut train. About 51 young children were killed on Saturday when a train collided with their bus on a railway crossing in Manfalut, 356 kilometres (220 miles) south of Cairo.

The EGX has delayed its trading session of Sunday for a minute as it started at 10:31a.m. amid high expectations of witnessing downwards due to the current political scene including the Egyptian church and Wafd Party’s withdrawal from the constituent assembly to draft the country’s new constitution.

The investors on Sunday lost their appetite due to the mounting death toll in Gaza, which, as of Sunday, reached more than 60.

Ashraf Abdel-Aziz, head of institutional sales at Cairo-based Arabeya Securities, said the Egyptian market had also suffered from Saturday’s road/rail collision in the Upper Egyptian Assiut Governorate in which more than 50 children were killed.

Traded volume reached 62.215 million securities worth EGP 158.427 million, exchanged 10.519 thousand transactions.

This was after trading in 151 listed securities; 58 declined 60 advanced while 33 keeping their previous levels.

EGX30’s rebound was backed by Egyptians and Arabs’ buying transactions.

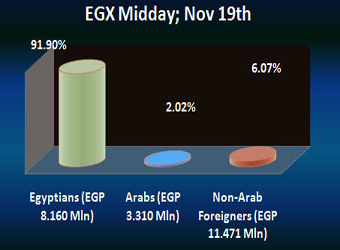

Egyptians and Arabs were net buyers seizing 91.9% and 2.02% respectively, of the total markets, with a net equity of EGP 8.160 million and EGP 3.310 million excluding the deals.

On the other hand, the non-Arab Foreigners were net sellers seizing 6.07% of the total markets, with a net equity of EGP 11.471 million excluding the deals.