During Thursday closing session, the Egyptian Exchange (EGX) has rebounded by posting gains of EGP 398 million as the capital market has amounted to EGP 333.641 billion.

Egyptian President Mohamed Morsi asked Tuesday Hisham Kandil, the minister of water resources and irrigation little known outside Egypt, to form a new government, state media reported on Tuesday.

Kandil was a senior bureaucrat in the ministry until he was appointed minister in July last year in the wake of the overthrow of President Hosni Mubarak.

The main index, EGX30 went up 0.16% to close at 4753.12 p. EGX20 retreated 0.03% to end at 5440.99 p.

Meanwhile, the mid- and small-cap index, the EGX70 edged up 0.85% to finish at 427.87 p. Price index EGX100 inched higher 0.73% to conclude at 730.94 p.

Traded volume reached 161.899 million securities worth EGP 281.847 million, exchanged through 16.414 transactions.

This was after trading in 162 listed securities; 40 declined 99 advanced while 23 keeping their previous levels.

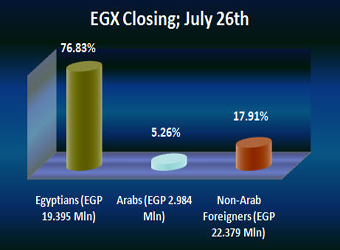

Egyptians and Arabs were net buyers seizing 76.83% and 5.26% respectively, of the total markets, with a net equity of EGP 19.395 million and EGP 2.984 million excluding the deals.

On the other hand, the non-Arab Foreigners were net sellers seizing 17.91% of the total markets, with a net equity of EGP 22.379 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance.

EFG-Hermes Holding:

The shares of EFG-Hermes Holding (HRHO.CA) dived 1.38% to conclude at EGP 10.75 amid the Egyptian Financial Supervisory Authority (EFSA)’s Wednesday announcement regarding halting Hermes’ joint venture deal with QInvest.

Later on Thursday, the Egyptian investment bank EFG-Hermes (HRHO.CA) announced that it expects a planned tie-up with Qatar’s QInvest to go ahead before October.

“The group is confident that the previously announced plan for the deal will be completed by the end of the third quarter of 2012,” EFG-Hermes said in a statement on Thursday.

The bank said that it would call another extraordinary shareholder meeting soon to provide the additional disclosure that the EFSA required “as we are committed to full transparency”.

The EFSA rejected decisions approved by EFG shareholders last month because the firm did not clarify points including minority rights.

Dr. Ashraf Al-Sharkawy, EFSA Chairman, was quoted as saying that EFG-Hermes must provide the required information and reconvene shareholders meeting for the deal to be completed.

Commercial International Bank:

The shares of Commercial International Bank- Egypt (CIB) (COMI.CA) inched lower 1.42% to end at EGP 27.10.

Talaat Moustafa Group:

The shares of Talaat Moustafa Group (TMGH.CA) edged down by 0.25% to close at EGP 3.95.

Orascom Telecom Media & Technology Holding:

The shares of Orascom Telecom Media & Technology Holding (OTMT.CA) jumped by 2.04% to close at EGP 0.50.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) soared by 1.62% to finish at EGP 252.21.

NBK Capital issued a report on Orascom Construction Industries (OCI) (OCIC.CA), defining the stock’s 12-month fair value at EGP 292.50, compared to its market price of EGP 248.20 and recommending an “Accumulate”.

Citadel Capital:

Shares of Citadel Capital surged by 0.34% to end at EGP 2.92 after falling Wednesday to the lowest close in more than a week after the Egyptian private equity firm called off the sale of its stake in National Petroleum Co.

Pharos Research commented on the news that Citadel Capital (CCAP.CA) entered into a termination agreement with Golden Crescent Investments, an Opportunity-Specific Fund controlled by the firm, to end the previously announced sale of the National Petroleum Company (NPC) to Sea Dragon Energy due to the uncertainty regarding the date of sale as well as ongoing economic turbulence locally and internationally.

Pharos’ Hamza Al-Assad described the termination of the sale agreement as cash-negative as well as strategically-negative in as much as it continues to undermine CCAP efforts to exit from non-core investments and increase its stakes in core investments.

“In March 2011, CCAP had agreed with Sea Dragon to purchase NPC for a total consideration of $147.5 million, split into $87.5 million in the form of Sea Dragon shares and $60.0 million in cash. It is interesting to note that the deadline for Sea Dragon to finalize the sale was set at 10 August 2012”, he added.

Orascom Telecom Holding:

The shares of Orascom Telecom Holding (OTH) (ORTE.CA) inched higher 0.31% to finish at EGP 3.21.