During Monday closing session, the Egyptian Exchange (EGX) has trimmed its midday losses to eventually reach EGP 851 million as the capital market has amounted to EGP 379.886 million.

The EGX indices closed mixed.

The main index, EGX30 rose by 0.38% to close at 5470.31 p. EGX20 inched lower by 0.05% to end at 6344.27 p.

Meanwhile, the mid- and small-cap index, the EGX70 pushed down by 0.97% to conclude 505.12 pts. Price index EGX100 dropped by 0.54% to finish at 837.44 p.

Traded volume reached 143.892 million securities worth EGP 489.458 million, exchanged 29.984 thousand transactions.

This was after trading in 173 listed securities; 108 declined 39 advanced while 26 keeping their previous levels.

EGX’s closing losses were driven by local investors’ selling pressures.

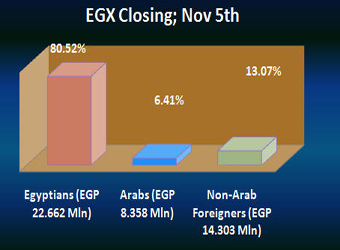

Egyptians were net sellers seizing 80.52 % of the total markets, with a net equity of EGP 22.662 million excluding the deals.

On the other hand, Arabs and the non-Arab Foreigners were net buyers 6.41% and 13.07% respectively, of the total markets, with a net equity of EGP 8.358 million and EGP 14.303 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) pushed down by 1.24% to end at EGP 11.16.

The Egyptian Financial Supervisory Authority (EFSA) negated in a release issued late Sunday that it had given any final approval for the strategic alliance between the EFG-Hermes (HRHO.CA) and the Qatari investment bank QInvest. EFSA added that there are further procedures shall be adopted prior its approval.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA)’s stock climbed by 1.75% to finish at EGP 0.58.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) went up by 1.74% to conclude at EGP 3.51.

On Saturday, Vimpelcom announced that it has hired Standard Chartered to advise it on the sale of its businesses in Burundi, Zimbabwe, Central African Republic, Cambodia and Laos, two people familiar with the matter said.

New-York listed Vimpelcom wants to focus on its largest markets of Russia and Italy, while reducing its debt, the people said. The units on the block came to Vimpelcom when it bought a 51 percent stake in Egypt-based Orascom Telecom and all of Italy’s Wind in 2011 for $6 billion.

“The move is part of a wider strategy by the company to review some of their smaller businesses globally and especially in emerging markets,” said a source familiar with the transaction.

“The group has really grown in size post the Orascom deal and there is a feeling that they need to be only in markets which are strategically important and of relevant size.”

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock pushed up by 1.35% to close at EGP 3.75.

Citadel Capital announced on Monday the start of pilot operation at the Arab National Cement Company (ANCC)’s new plant located in the Upper Egyptian governorate of Minya, at a production capacity of 2 million tpa.

The Arab National Cement Company (ANCC), a subsidiary of regional cement producer ASEC Cement, is located some 220 kilometers south of Cairo in the Minya governorate. In addition to creating 400 direct and 1,500 indirect jobs, the plant will provide cement for key infrastructure projects in Upper Egypt.

ANCC is a project of ASEC Cement, a 33.44%-owned investment platform of Citadel Capital.

Orascom Construction Industries:

Trading for Orascom Construction Industries – OCI (OCIC.CA)’s stock has been suspended on Monday.

On Monday, Omar Derwaza – Head of Investor Relations at Orascom Construction Industries – said OCI is still in holds negotiations with Egypt’s Tax Authority (TA) so as to put an end to the tax evasion charges against the Group.

Derwaza added that the meeting held on Sunday between the TA and OCI representatives has discussed the overall dimension to the tax evasion charges and the Group’s legal stance expecting that the TA and OCI will likely reach an agreement very soon.