During Wednesday closing session, the Egyptian Exchange (EGX) has extending posting gains which eventually hit EGP 5.1 billion as the capital market has amounted to EGP 399.031 million.

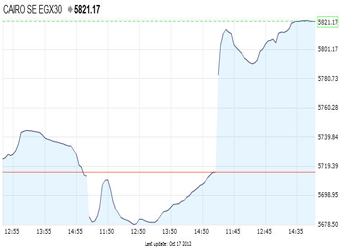

EGX indices closed in green for the second successive trading session.

The main index, EGX30 surged by 1.85% to close at 5821.06 p.

Meanwhile, the mid- and small-cap index, the EGX70 climbed by 1.89% to conclude at 538.49 pts. Price index EGX100 hiked by 1.71 % to end at 890.68 p.

Traded volume reached 281.127 million securities worth EGP 599.587 million, exchanged through 29.520 thousand transactions.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during the closing.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) soared by 8.93% to end at EGP 0.61.

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock jumped by 2.69% to close at EGP 4.20.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) climbed by 2.49% to conclude at EGP 3.71.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) surged by 2.34% to finish at EGP 12.25.

Orascom Construction Industries:

Orascom Construction Industries – OCI (OCIC.CA)’s stock hiked by 1.71% to end at EGP 271.10.

SODIC:

Six of October Development & Investment Company – SODIC – (OCDI.CA)’s stock pushed up by 1.11% to conclude at EGP 22.70.

On Wednesday, SODIC has reported total sales of its flagship Kattameya Plaza residential project of EGP 120 million during the first nine months of 2012.

Sources from SODIC told Amwal Al Ghad that Kattameya Plaza residential project consists of 41 residential buildings, 658 apartments on a total land area of 126.000 m2. The project is expected to finish by the end of 2014, the sources noted.

The sources further added that SOREL (99% owned by Sixth of October Development & Investment Company – SODIC) has signed a contract with the Arab Investment Bank (AIB) signed a contract over credit facilities of EGP 120 million.

Such credit facilities will be used to finance the establishment of Kattameya Plaza. Amwal Al Ghad earlier reported exclusively that SODIC requested such finance last July from AIB. The three-year term finance is the first to be received by SODIC from AIB.