During Monday opening session, the Egyptian Exchange (EGX) has posted losses of EGP 8.2 billion as the capital market has amounted to EGP 335.565 billion, according to data compiled by Amwal Al Ghad at 11:07 a.m. Cairo time (09:07 GMT).

The EGX has resumed trading at 11:01 a.m. after it was halted due to the indices’ opening losses which exceeded 5%.

The EGX indices opened in dark red for the second day.

The main index, EGX30 pushed down by 3.57% to 4742.1 p. EGX20 fell by 2.58% to 5489.15 p.

Meanwhile, the mid- and small-cap index, the EGX70 sank by 3.71% to 425.38 pts. Price index EGX100 dived by 4.21% to 705.5 p.

Traded volume reached 9.954 million securities worth EGP 21.331 million, exchanged 1.377 thousand transactions.

This was after trading in 129 listed securities; 94 declined, 7 advanced; while 28 keeping their previous levels.

EGX’s losses were driven by local selling pressures.

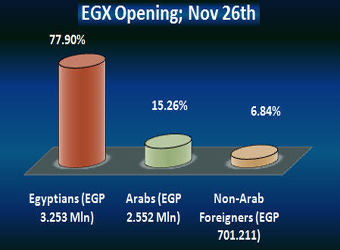

Egyptians were net sellers seizing 77.9% of the total markets, with a net equity of EGP 3.253 million excluding the deals.

Mohamed Gaballah, Finance and operation Manager at Arab Finance Brokerage company, has attributed the Egyptian Exchange’s Sunday sharp decline to the domestic division over President Mohamed Morsi’s new constitutional declaration issued last Thursday.

Gaballah further told CBC local channel that Morsi’s constitutional decree has sharply divided the country into supporters and opponents triggering controversies among political parties and the general public which in return have heighten the political tensions.

Accordingly, the investors have been in a state of panic and fear recalling the EGX’s drastic decline before the outbreak of the 25th January revolution, he added. Gaballah noted that the Egyptian investors are more worried than Arabs and non-Arab foreigners.

On the other hand, Arabs and the non-Arab Foreigners were net buyers seizing 15.26% and 6.84% respectively, of the total markets, with a net equity of EGP 2.552 million and EGP 701.211 thousand excluding the deals.

The benchmark stock index surrendered its spot as the world’s best performer this year after renewed political unrest in the country triggered the worst drop since last year’s uprising.

EGX30, which tumbled the most on Sunday (Black Sunday) since the start of last year’s uprising, slid 3.9 percent to 4,726.04 at 10:37 a.m. in Cairo today, trimming this year’s gains to 31 percent. The measure lost the top spot to Pakistan’s Karachi 100 Index and fell to fifth place among 93 indexes tracked by Bloomberg. The Egyptian pound, subject to managed float, weakened 0.2 percent, the biggest intraday drop since December 2011, to 6.1042 a dollar.

“Egypt has a political risk factor, which will affect sentiment in the short-term,” says Marwan Shurrab, vice-president and chief trader at Gulfmena Investment. “It has rallied aggressively after the revolution – a sell off like yesterday is expected.”

Investors said protests in Egypt were affecting sentiment across the Gulf region.