Egypt reports 54.7mn active financial accounts, CBE readies 2026-2030 inclusion plan

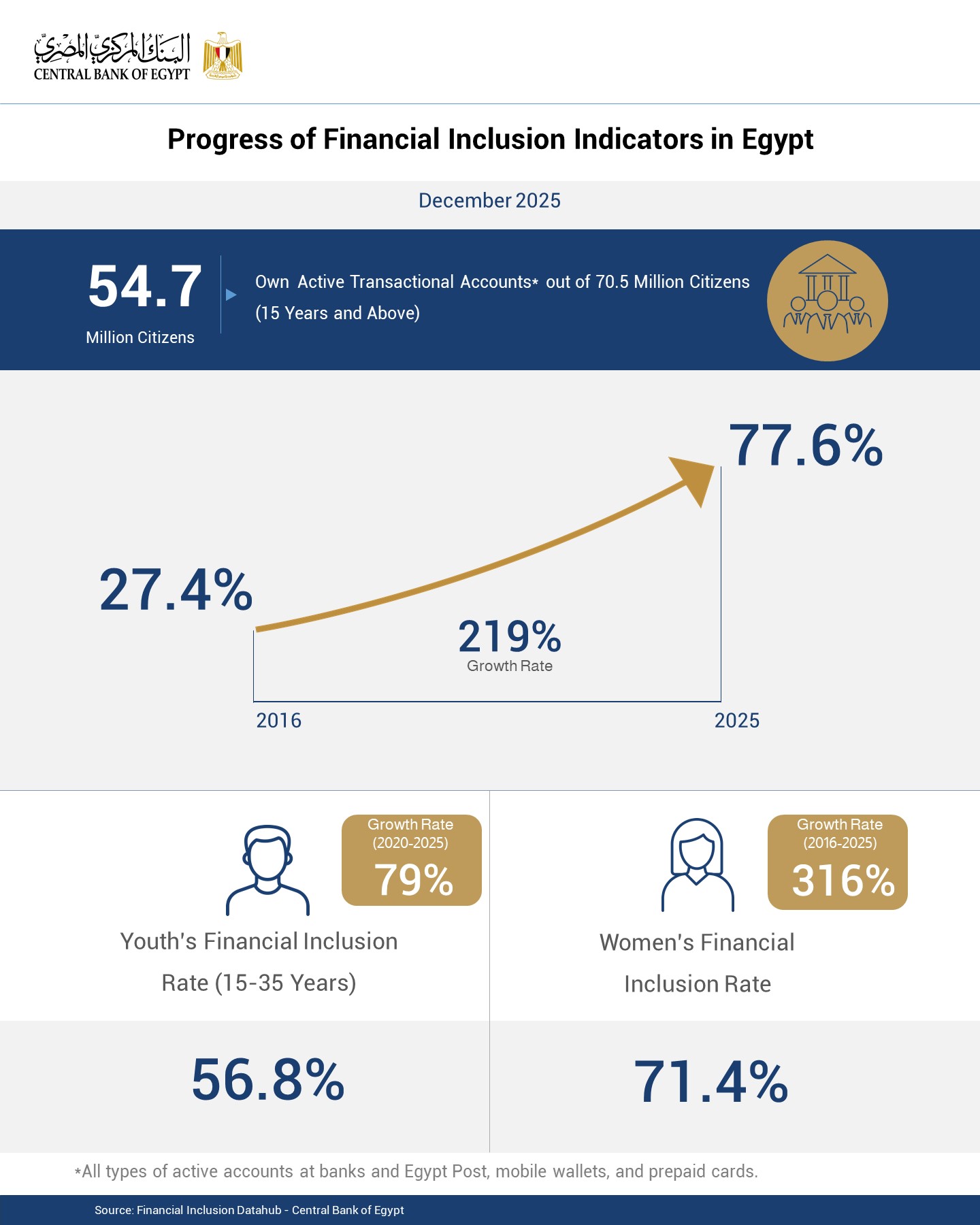

Egypt now counts 54.7 million citizens with active transactional accounts, the Central Bank of Egypt (CBE) said Tuesday, as it moves forward with a second financial inclusion strategy for 2026–2030.

The milestone comes after the first Financial Inclusion Strategy (2022–2025) successfully boosted the country’s financial inclusion rate to 77.6 per cent by the end of 2025. Active accounts include bank accounts, Egypt Post accounts, mobile wallets, and prepaid cards, covering citizens aged 15 and older out of a total population of 70.5 million.

The strategy produced significant gains for women and youth. Women’s inclusion jumped 316 per cent from 19.1 per cent in 2016 to 71.4 per cent in 2025, while financial access among youth aged 15–35 rose from 36.3 per cent in 2020 to 56.8 per cent in 2025. The expansion reflected targeted programmes aimed at empowering underserved groups and integrating them into the formal financial system.

The CBE’s second strategy is being developed in coordination with key ministries, including Finance, Planning and Economic Development, Communications and IT, Social Solidarity, Agriculture, Education, Youth and Sports, and Investment. Oversight and implementation will involve the Financial Regulatory Authority (FRA), Egypt Post, MSMEDA, and the National Council for Women (NCW), and the Internal Trade Development Authority (ITDA).

Evidence-based policy is central to the new strategy. Ongoing demand-side surveys of individuals and micro, small, and medium-sized enterprises, conducted with CAPMAS and technical support from the World Bank Group and the International Finance Corporation (IFC), are identifying gaps in access and use to inform policy design.

Planned priorities include expanding digital financial services, supporting sustainable financing for the green economy, improving financial literacy, safeguarding consumer rights, promoting SME growth, strengthening public-private partnerships, and modernising financial infrastructure.

The CBE said the first strategy’s achievements demonstrate Egypt’s commitment to financial inclusion as a driver of economic growth and social development, with the second strategy expected to deepen access and resilience across the population.

Attribution: Amwal Al Ghad English