In a week, Egyptian shares attained significant gains in the amount of EGP 12.3 billion powered by coinciding with Egypt army’s chief’s historic visit to Russia amid news of nearing a multi-billion arms deal. In Return, Egypt’s main bourse index surged 2.2% in a week.

Last week, Field Marshal Abdel Fattah Sisi paid his first trip abroad since he overthrew president Mohamed Morsi in July, setting off months of deadly unrest.

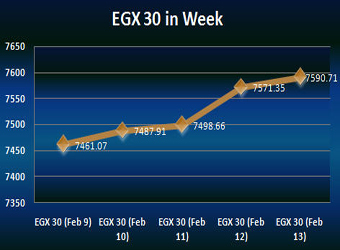

The Egyptian Exchange’s benchmark index EGX 30 index climbed by 2.2% this week, registering a surge of 164.56 points, ending Thursday’s transactions at 7590.71 points compared to 7426.17 points at the end of a week earlier.

The main gauge index registered its highest point on Thursday closing at 7590.71 points, where its lowest point recorded on Sunday at 7461.07 points.

Meanwhile, the mid- and small-cap index, the EGX70 jumped by 5.1% closing at 642.91 points during Thursday’s session, compared to 611.15 points at the end of a week earlier. The price index, EGX100 also pushed up by 5.8% concluding by 1096.56 points during Thursday’s session, against 1036.44 points at the end of a week earlier.

Furthermore, the market capitalization closed at EGP 470.653 billion last Thursday, compared to EGP 458.380 billion at the end of a week earlier.

Russian Visit

Russian and Egyptian media were awash with reports of a multi-billion dollar arms deal funded by Gulf Arab states to replace aid suspended by Washington following Morsi’s ouster and a deadly crackdown on the Islamist’s followers.

Issandr El Amrani, North Africa project director at International Crisis Group, said the visit might have been intended as much for show as substance.

It was part of a “carefully orchestrated process by which he would declare his candidacy,” El Amrani said.

“There was the publication of pictures in which Sisi is seen for the first time in civilian attire, and he gets to stand next to a world leader like Putin,” he said.

Turnovers & Traded Volumes:

Through the week, the trading volume hit 1.1 billion securities, compared to 1.4 billion securities at the end of a week earlier. For the traded value, it reached EGP 5.831 billion against EGP 6.039 billion a week earlier.

Sectors Activity:

Financial Services excluding Banks was the most active sector through last week, recording a volume of trades of 273 million securities worth EGP 763 billion.

Telecommunications came second, attaining a volume of trades of 193 million securities worth EGP 364 million.

Real Estate reported third, with a volume of trades of 165 million securities worth EGP 793 million.

Personal and Household Products was on the fourth position, getting a volume of trades of 103 million securities worth EGP 388 million.

Industrial Goods and Services and Automobiles came fifth, recording a volume of trades of 102 million securities worth EGP 222 million.

Travel & Leisure sector reported sixth, having a volume of trades of 97 million securities worth EGP 252 million.

Food and Beverage reported eighth, attaining a volume of trades of 37 million securities worth EGP 343 million.

Food and Beverage reported eighth, attaining a volume of trades of 37 million securities worth EGP 343 million.

Healthcare and Pharmaceuticals was on the ninth position, with a volume of trades of 27 million securities worth EGP 39 million.

Banks reported tenth, recording a volume of trades of 15 million securities worth EGP 380 million.

Basic Resources came eleventh, attaining a volume of trades of 8.2 million securities worth EGP 116 million.

At the bottom of the list, Chemicals reported twelfth getting a volume of trades of 5.9 million securities worth EGP 70.9 million.

Investors’ Activity:

Local investors led the market activity all through the week with 88.61%, followed by Foreign and Arab investors with 5.76% and 5.63%, respectively.

Foreign investors were the most active buyers during the week earning the value of EGP 41.88 million , after excluding the deals.

Arab investors were also to sell by value of EGP 6.01 million, after excluding the deals.

Moreover, institutions seized 45.64% of total trading through the week; while individuals attained 54.36% . Institutions were the most active buyers during the week earning the value of EGP 255.74 million, after excluding the deals.