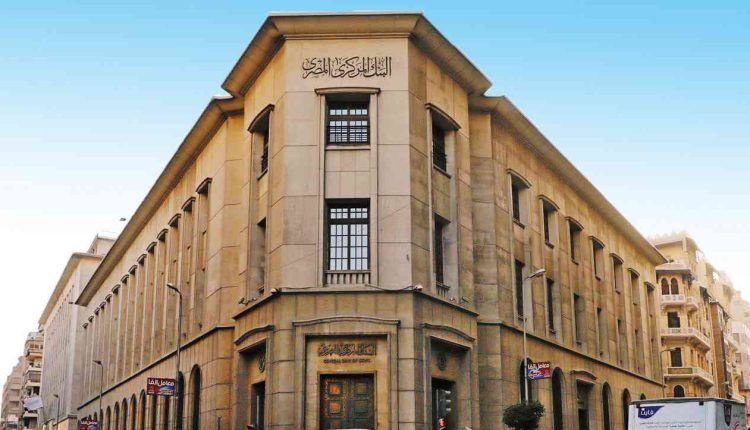

The Central Bank of Egypt (CBE) on Monday offered fixed-rate treasury bonds (t-bonds) with maturities of three and five years, worth 3.5 billion Egyptian pounds ($74,5million), in coordination with the Ministry of Finance, according to a statement on its website.

The three-year bond is valued at 3 billion pounds with a 25.021 per cent coupon rate, maturing on 07-05-2027, and pays returns semi-annually. While, the second bill is valued at 500 million pounds, to be maturated on 28-05-2029.

A coupon is an annual interest paid on a bond. Investors receive a coupon payment, either annually or biannually, from issuance until maturity, if they hold the bond, as explained by DailyForex website.