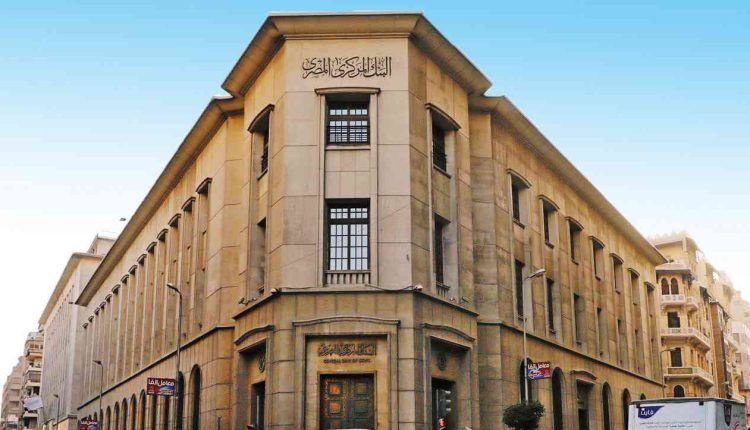

Egypt’s central bank (CBE) has released on Saturday its financial inclusion indicators for 2022, as the figures showed that the country’s financial inclusion rates have improved between 2016 and 2022 by 147 percent.

The report added the overall number of Egyptians who now have accounts in banks, Egypt Post, mobile phone wallets, or prepaid cards has reached 42.3 million, which represents 64.8 percent of Egyptians above the age of 16 (65.4 million citizens).

CBE also declared that the women’s financial inclusion money accounts rose to 18.3 million women by the end of 2022, representing a growth rate of 210 percent compared to 2016.

The figures also showed that the number of financial access points – which include; banks’ network of branches, Egypt Post, Microfinance Institutions, ATMs, POSs, and Payment Service Providers – has reached 1,214 points per 100,000 citizens.

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.