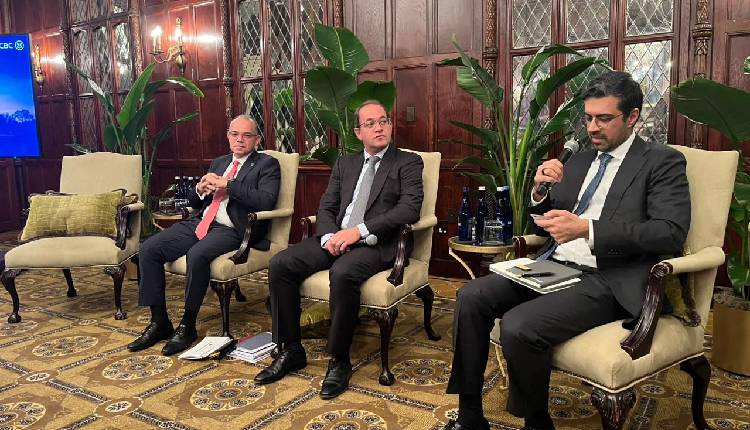

Egypt’s Financial Regulatory Authority (FRA) Chairman Mohamed Farid highlighted reforms in the country’s non-banking financial sector during meetings with Standard Chartered and Citibank officials on the sidelines of the International Monetary Fund and World Bank Annual Meetings in Washington, D.C.

According to a FRA statement on Wednesday, Farid said the FRA’s structural and regulatory reforms complement Egypt’s broader economic reform programme, aiming to deepen financial markets, expand participation, and transform economic growth into tangible financing opportunities for citizens and businesses.

He noted that the FRA has implemented legislative and structural reforms across insurance, capital markets, and non-banking finance to build a more efficient and resilient financial sector. A key milestone is the Unified Insurance Law No. 155 of 2024, which strengthens solvency, expands coverage, and promotes broader insurance inclusion.

In capital markets, reforms focus on transparency, investor protection, and encouraging wider participation on the Egyptian Exchange (EGX), alongside the development of financing tools for SMEs and advancement of sustainable and green finance initiatives.

Farid also emphasised the FRA’s leadership in digital transformation, including adoption of financial technology, creation of electronic supervision platforms, and launch of a FinTech regulatory sandbox to foster innovation while ensuring consumer protection. These initiatives aim to boost financial inclusion, improve access to finance, and reinforce the sector’s role in supporting Egypt’s economic growth.

Attribution: Amwal Al Ghad English

Subediting: Y.Yasser